Olectra Share Price: Current Trends and Market Insights

Importance of Tracking Olectra Share Price

Olectra Greentech Limited, a leading player in the electric vehicle sector in India, has gained significant attention from investors and analysts alike. The company’s commitment to sustainable transportation solutions makes its share price a crucial indicator for economic and environmental progress in India. Keeping track of Olectra’s stock performance not only reflects the company’s growth but also provides insights into the burgeoning electric mobility market.

Recent Performance and Market Factors

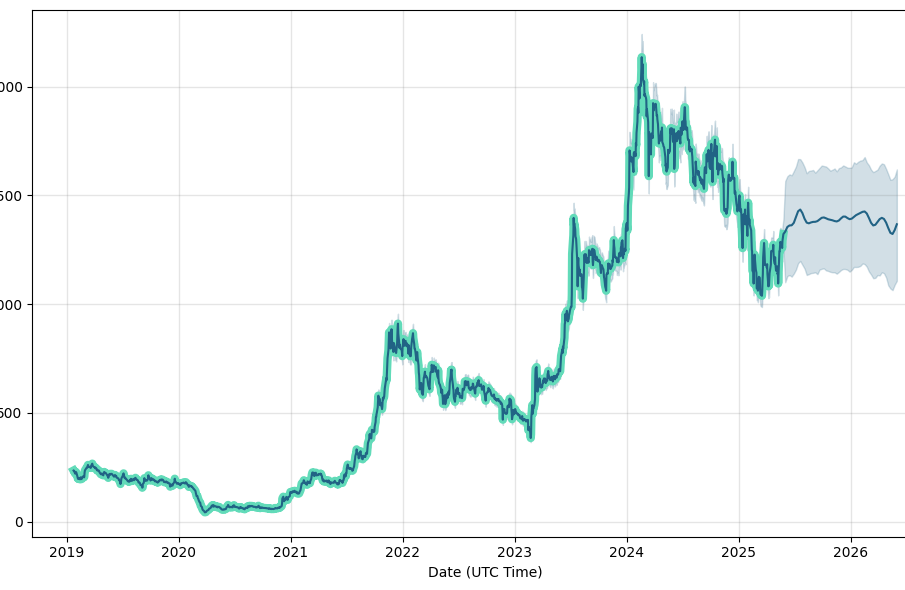

As of October 2023, Olectra’s share price has been experiencing notable fluctuations. After reaching an all-time high of ₹420 in mid-September, the stock has seen a pullback due to broader market corrections and profit-booking by investors. Currently, Olectra’s share price hovers around ₹370, reflecting a decrease of approximately 12% from its peak. Market analysts attribute this dip to both external economic factors, such as rising material costs and changes in government policies, as well as internal company-specific challenges.

The electric vehicle industry in India is on an upward trajectory, supported by government initiatives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, which has created a conducive environment for companies like Olectra. Moreover, the rising consumer push for clean energy vehicles continues to bolster optimism among investors. However, it is essential for potential investors to remain cautious amid the market’s volatility.

Expert Insights and Future Outlook

Experts suggest that Olectra’s current share price presents a good entry point for long-term investors. The company has consistently focused on innovation, and recent collaborations with local governments to provide electric buses demonstrate a forward-thinking strategy. Additionally, with plans to expand its production capabilities and product line, Olectra is poised for growth.

Looking ahead, analysts predict that the share price could rebound, especially if the government continues to support the electric vehicle sector through incentives and infrastructure development. Market trends indicate a growing acceptance of electric vehicles among consumers, which could translate into higher sales for Olectra and, subsequently, an increase in share price.

Conclusion

In summary, Olectra’s share price remains a vital aspect of monitoring not only the company’s performance but also the electric vehicle industry in India as a whole. Investors should keep a close eye on market trends, government policies, and company announcements that could impact Olectra’s stock. With the right strategic moves and favorable market conditions, Olectra could emerge stronger, providing both environmental benefits and an attractive return on investment.