NVIDIA Share Price: Trends, Insights, and Future Outlook

Introduction

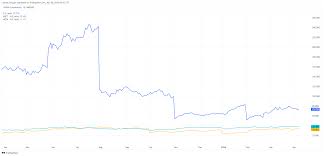

The NVIDIA share price has become a focal point for investors and tech enthusiasts alike, especially as the company plays a significant role in sectors such as gaming, artificial intelligence, and data centers. As one of the leading semiconductor manufacturers, NVIDIA’s stock performance is closely monitored, not only for its market value but also for its potential impact on the tech industry as a whole.

Current Share Price Performance

As of October 2023, NVIDIA’s share price has seen significant fluctuations, largely influenced by both macroeconomic factors and company-specific developments. At the beginning of the month, the share price was around ₹11,500, reflecting a slight increase from the previous month’s closing price of ₹11,000. However, just within a week, the stock dipped to approximately ₹11,200 due to concerns over supply chain disruptions and weaker than expected quarterly earnings.

Factors Influencing the Share Price

The volatility of NVIDIA’s share price can primarily be attributed to several key factors:

- Market Demand for GPUs: Increased demand for graphics processing units (GPUs) in gaming, AI processing, and cryptocurrency mining significantly affects NVIDIA’s revenues and subsequently its share price.

- Competitive Landscape: The rise of competitors in the semiconductor industry can influence investor sentiment and stock performance.

- Regulatory Environment: Changes in trade policies or regulatory measures, particularly concerning technology exports, impact NVIDIA’s operations globally.

- Earnings Reports: Quarterly earnings releases often lead to immediate changes in stock prices based on revenue expectations and profit margins.

Future Forecast

Looking ahead, analysts remain cautiously optimistic about NVIDIA’s share price trajectory. With ongoing advancements in AI and machine learning, along with the burgeoning virtual reality market, NVIDIA is positioned to tap into new revenue streams. However, external economic pressures, including rising interest rates and inflation, may impact investor confidence.

Conclusion

The NVIDIA share price serves as a litmus test for the broader tech market, reflecting both the company’s performance and industrial trends. Investors should remain vigilant, considering both the opportunities and risks in this dynamic landscape. The shift towards more advanced technologies promises a significant potential upside, but uncertainty in the market highlights the importance of making informed investment decisions.