NSE Pre Market: Key Trends and Insights for Investors

Introduction

The National Stock Exchange (NSE) is crucial for investors and traders in India, providing an effective platform for securities trading. Understanding the pre-market activity on the NSE is essential for predicting market trends and making informed trading decisions. The pre-market session allows participants to gauge market sentiment before the regular trading hours and can significantly impact investment strategies.

What is NSE Pre Market?

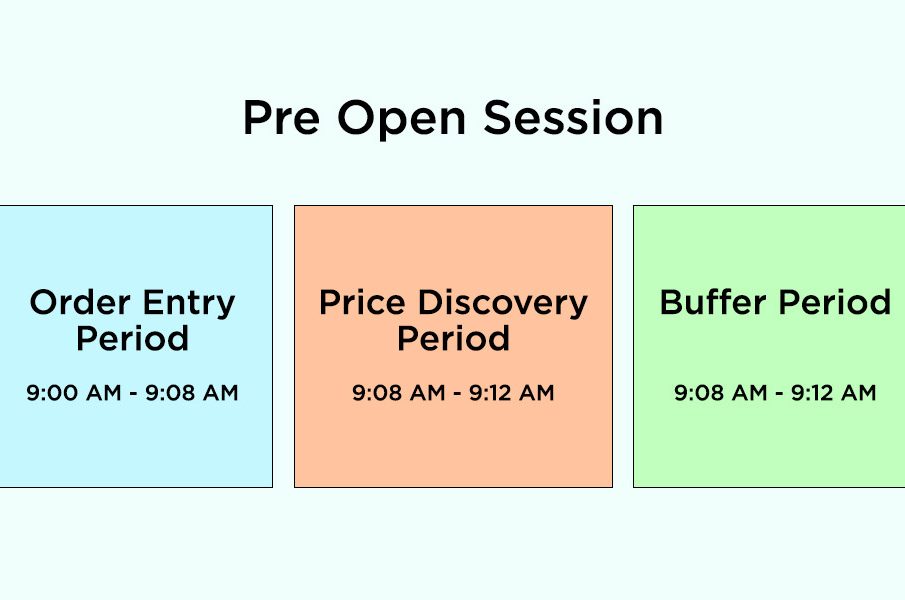

The NSE pre-market session typically operates from 9:00 AM to 9:15 AM, before the official market opening at 9:15 AM. During this time, traders can place orders, and the market reflects the collective sentiment through price discovery. This session is key in revealing insights about buying and selling pressures, which can forecast how stocks might perform when the market opens.

Recent Trends in Pre-Market Activity

In recent weeks, the NSE pre-market has seen fluctuations due to varying economic indicators. For instance, on October 10, 2023, pre-market trading was influenced by US economic data showing an unexpected increase in inflation. Consequently, this led to apprehension regarding interest rates, which was reflected in a bearish sentiment among traders. Conversely, positive earnings reports from major companies can lead to bullish pre-market behavior.

Analyzing Market Indicators

Traders often look at several indicators during the pre-market session. This includes global market trends, especially movements in US and Asian markets, commodity prices, and significant news events. A notable recent event was a surge in crude oil prices, which resulted in fluctuations in energy stocks even before the regular market opened. This vital data allows traders to position themselves strategically for the day ahead.

The Importance of Pre-Market Insights

For day traders and long-term investors, keeping an eye on pre-market activity can yield advantages. It helps in adjusting trading volumes and timings. Pre-market trends often set the tone for the trading day. Investors who analyze this data carefully can pinpoint opportunities or risks they may not see once regular trading begins.

Conclusion

The NSE pre-market session presents a unique opportunity for traders to assess market conditions and prepare for the day’s trading. As we move forward, the importance of monitoring pre-market trends will likely intensify, enabling investors to stay ahead in a highly dynamic market environment. Understanding these insights not only aids in making better investment decisions but also fosters a more informed and responsive trading approach.