NCC Share Price: Trends and Investor Insights

Importance of Monitoring NCC Share Price

The share price of NCC Limited, a leading infrastructure development company in India, holds significant relevance for investors and market analysts. As the company engages in various large-scale projects, its share performance is often indicative of broader trends within the construction and infrastructure sector. Understanding NCC’s share price trends can provide valuable insights into economic health and investor sentiment.

Current Market Overview

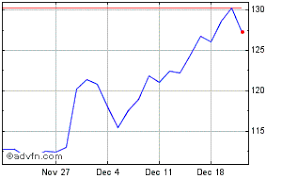

As of October 2023, NCC shares are trading at approximately ₹95 per share, reflecting a notable fluctuation in recent months. The stock has seen a peak of ₹105 earlier this month, driven by positive quarterly earnings reports and an increase in infrastructure spending by the government. Conversely, fluctuations in raw material prices and global market sentiments have contributed to the volatility, which investors are closely monitoring.

Latest Developments Impacting NCC Share Price

Several key factors have recently influenced NCC’s share price:

- Quarterly Earnings: NCC announced a 15% year-on-year growth in net profit for the second quarter, attributed to increased project completions and tighter cost management strategies.

- Government Projects: The Indian Government’s emphasis on infrastructure development, including roads and urban housing, has provided a boost to NCC’s future project prospects, which helped stabilize the share price.

- Market Sentiment: Despite the overall positive outlook, global economic uncertainties, such as inflation might affect investor confidence, resulting in periodic sell-off of shares.

Investors are advised to stay informed about government policies and macroeconomic indicators that may affect infrastructure spending.

Forecasts and Investment Strategies

Market analysts suggest that NCC’s share price may stay buoyant in the run-up to the festive season, driven by increased government expenditure and the upcoming infrastructure projects. However, investors should be prepared for short-term fluctuations based on external market conditions. Diversifying investments and considering long-term holds in NCC could mitigate risks associated with its volatility.

Conclusion: The Significance of NCC Share Price Tracking

Tracking the NCC share price is essential for making informed investment decisions. As infrastructure plays a crucial role in economic recovery post-pandemic, companies like NCC are poised to benefit. Investors should continue to analyze market trends and the company’s performance to maximize their investment potential in the dynamic landscape of India’s infrastructure sector.