MTAR Share Price: Current Trends and Future Outlook

Introduction

MTAR Technologies Ltd is a notable player in the Indian engineering sector, specializing in precision engineering and manufacturing for the aerospace, defense, and nuclear sectors. Its shares have garnered significant attention from investors over the past year, driven by the company’s growth trajectory and increasing demand for its high-tech products. As of late 2023, understanding the performance of MTAR share price is crucial not only for current shareholders but also for potential investors assessing opportunities in Indian equities.

Current Share Price Trends

As of October 2023, MTAR shares have shown remarkable volatility in the stock market. The shares opened at INR 1,750 at the beginning of the month but faced fluctuations influenced by broader market conditions and company-specific announcements. Recent reports indicate that MTAR’s share price reached a high of INR 1,850 before settling around INR 1,800. This current range reflects a moderate increase from their year-to-date average, attributed to strong quarterly earnings and favorable demand forecasts in the aerospace sector.

Factors Influencing MTAR Share Price

Several key factors are contributing to the movements in MTAR’s share price:

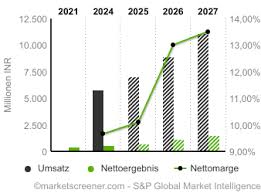

- Quarterly Earnings Reports: The latest earnings report highlighted a 25% increase in revenue year-on-year, driven by new contracts and projects in aerospace and defense, which positively influenced investor sentiment.

- Government Policies: The Indian government’s increasing focus on indigenous manufacturing and self-reliance in sectors such as defense and aerospace has buoyed expectations for MTAR’s growth.

- Market Volatility: Broader market trends and global economic conditions, such as inflation and interest rates, play a significant role in influencing investor behavior, hence affecting share prices.

Future Outlook

Looking ahead, analysts forecast a cautiously optimistic future for MTAR Technologies. With the Indian government’s continued investment in defense and aerospace capabilities, coupled with MTAR’s strong order book and innovative product pipeline, the share price has the potential for substantial growth. However, investors should remain aware of potential risks, such as market corrections and the impact of fluctuating raw material costs on profitability.

Conclusion

In conclusion, MTAR’s share price reflects a combination of solid fundamentals and market sentiment influenced by economic conditions and sectoral growth prospects. As the company continues to secure new opportunities and adapt to market changes, keeping an eye on its share price will be essential for investors looking to navigate this evolving landscape. Understanding these dynamics provides critical insights for making informed investment decisions in the technology-driven market of the future.