MRF Share Price: Current Trends and Future Predictions

Introduction

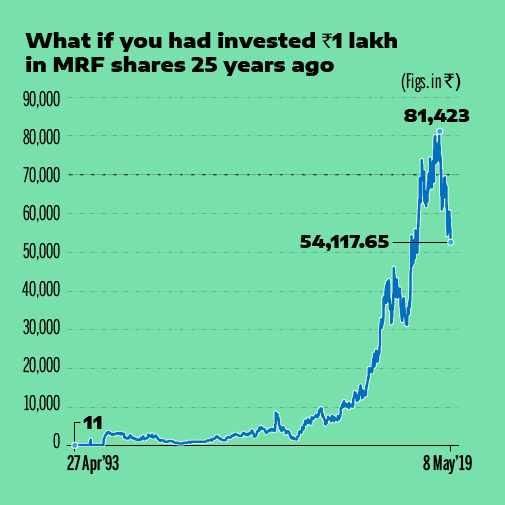

MRF Ltd (Madras Rubber Factory) is one of India’s leading tire manufacturers and a prominent player in the Indian stock market. The company’s share price carries significant importance, reflecting not just its financial health but also the overall automobile and manufacturing sectors in India. Recently, MRF’s share price has drawn considerable attention from both investors and analysts, making it vital to examine its current trends and implications.

Current Share Price Trends

As of October 2023, MRF’s stock is trading around ₹93,000, demonstrating a robust performance over the past few months. The stock has shown an upward trajectory, recovering from a dip earlier this year, thanks in part to improved automotive sales and increased demand for premium tires. The company’s quarterly results have also indicated strong revenue growth, which has positively influenced investor sentiment.

Factors Influencing MRF’s Share Price

Several factors are contributing to the fluctuation in MRF’s share price:

- Market Demand: The resurgence of the automotive industry post-pandemic, accelerated by a recovery in vehicle sales, has directly benefited MRF.

- Raw Material Costs: Variations in raw material prices, including rubber and petroleum products, greatly influence manufacturing costs and profit margins.

- Competitive Landscape: MRF’s competitive edge over domestic and international players, alongside its brand reputation, plays a critical role in maintaining its market position.

Future Outlook

Analysts remain optimistic about MRF’s prospects, with forecasts suggesting continued growth for the company’s share price in the next fiscal year. Factors such as advancements in tire technology, expansion into electric vehicle sectors, and efficient cost management are expected to bolster MRF’s market position.

Conclusion

Understanding MRF’s share price movements is crucial for investors seeking to navigate the complexities of the stock market. As MRF continues to innovate and adapt to market challenges, the potential for its share price to rise remains strong, making it a significant consideration for both current shareholders and potential investors. The coming months will be pivotal in determining how external economic factors and internal strategies will shape the company’s financial landscape.