MCX Share Price: Latest Trends and Market Analysis

Introduction

The Multi Commodity Exchange of India (MCX) is a leading commodity exchange in the country, playing a vital role in the trading of various commodities like gold, silver, and crude oil. As an important entity in financial markets, fluctuations in the MCX share price provide insights into the overall health of the commodity trading sector. Investors closely monitor these changes not only to strategize their trades but also to gauge market sentiment.

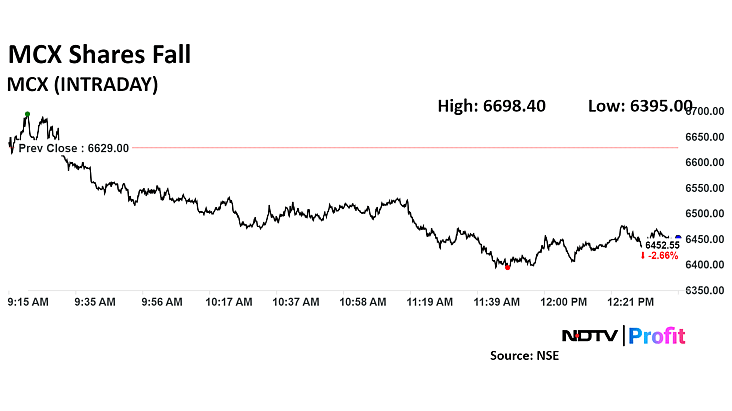

Current MCX Share Price Trends

As of October 2023, the MCX share price has shown considerable volatility, reflecting changing market conditions. Recent factors influencing the price include international commodity prices, regulatory changes, and macroeconomic indicators. According to recent reports, the MCX share price has recently risen by approximately 3%, reflecting increased investor confidence following a successful quarterly earnings report.

Data highlights from the last few weeks indicate that the share price peaked at INR 1,800 and saw a low of INR 1,700, showing a consistent range for traders. Analysts attribute the recent rise to increased trading volumes in precious metals, particularly gold and silver, which are traditionally safe-haven assets during economic uncertainty. Additionally, the government’s supportive policy framework for commodities trading is encouraging more participation in the sector.

Market Factors Influencing MCX Share Price

Several market factors have contributed to the current price trends of MCX shares. Firstly, the ongoing global economic recovery has increased demand for various commodities, which in turn has elevated trading activity on the exchange. Secondly, fluctuating inflation rates have led to renewed interest in commodities as a hedge against inflation.

Moreover, the MCX has introduced innovative trading solutions, such as options on commodities, to attract both institutional and retail investors. These developments have positively impacted the exchange’s operational efficiency and helped in sustaining investor interest, directly influencing the share price.

Conclusion and Future Outlook

Overall, the MCX share price reflects not only the trends within the commodity market but also the broader economic climate. As global commodity prices continue to fluctuate, investors and traders alike are advised to remain vigilant and well-informed. With ongoing developments in trading mechanisms and regulatory support, analysts predict a moderate growth trajectory for MCX shares in the next few quarters.

For investors eyeing opportunities in the commodity exchange space, understanding the dynamics influencing the MCX share price could prove pivotal in making informed investment decisions. Continuous monitoring of market conditions is crucial as investors adapt strategies in an evolving economic landscape.