Mazagon Dock Shipbuilders Share Price: Trends and Insights

Introduction

Mazagon Dock Shipbuilders Ltd (MDL), an integral player in India’s defense and maritime sectors, has gained significant attention recently due to fluctuations in its share price. Investors, market analysts, and stakeholders are closely monitoring these changes to assess the company’s growth potential and stability. Understanding these price shifts is crucial, especially as MDL continues to play a pivotal role in India’s naval capabilities and shipbuilding initiatives for defense and commercial purposes.

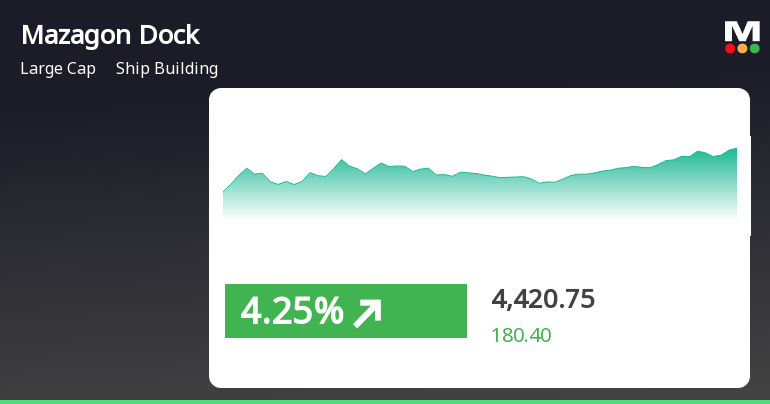

Current Share Price Trends

As of the latest trading session, the shares of Mazagon Dock Shipbuilders have experienced notable movements, with the current share price hovering around ₹1,260.65, witnessing an increase of approximately 2.45% from the previous day. Analysts attribute this rise to several factors, including strong quarterly earnings reports, robust defense allocations in the recent budget, and increased orders for naval vessels.

Market Performance and Financial Indicators

MDL’s recent financial performance has exceeded expectations, showcasing a surge in net profit by over 30% year-on-year. The company reported revenues bolstered by its increased capabilities in submarine construction and offshore services, vital in light of geopolitical shifts in the Asia-Pacific region. Currently, MDL’s earnings per share (EPS) stands at ₹65.15, contributing to a price-to-earnings (P/E) ratio that reflects positive investor sentiment.

Future Projections

Experts suggest that the share price of Mazagon Dock Shipbuilders could witness further growth driven by continued government investments in defense and naval infrastructure. The company is also expected to benefit from partnerships and collaborations with international defense firms, which may lead to expanded contracts and diversified revenue streams. Additionally, the global maritime market is projected to bounce back, providing a significant boost to shipbuilding companies like MDL.

Conclusion

In summary, Mazagon Dock Shipbuilders stands at a crucial juncture with promising financial indicators and increasing orders. Investors looking to enter or expand their stake in MDL should consider market trends, government policies, and the firm’s operational capabilities while anticipating future developments. The ongoing situation suggests a cautiously optimistic outlook for the share price of Mazagon Dock Shipbuilders, making it an interesting prospect for both short-term and long-term investment strategies.