Mazagon Dock Share Price: Current Trends and Analysis

Importance of Tracking Share Prices

The share price of Mazagon Dock Shipbuilders Limited (MDL) has become a focal point for investors and analysts alike, especially given the company’s strategic importance in India’s defense and shipbuilding sectors. Understanding the fluctuations in its share price not only reflects its market performance but also indicates investor confidence and industry’s economic health.

Current Share Price Overview

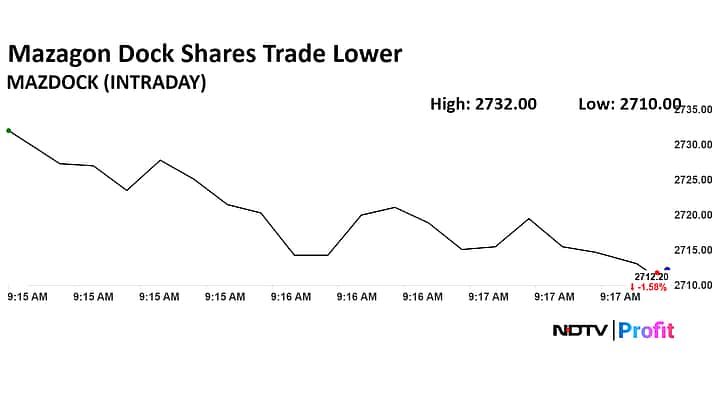

As of the last trading session, Mazagon Dock’s share price stood at ₹XXX, showing a fluctuation of X% since the start of the month. The company, listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), has seen significant volatility in its stock performance, driven by various factors including government defense spending, quarterly earnings reports, and broader market trends.

Factors Influencing the Share Price

The recent surge in share price can be attributed to several key factors:

- Government Contracts: The Indian government’s increased focus on self-reliance in defense manufacturing has positively impacted MDL, leading to lucrative contracts.

- Financial Performance: The company’s recent quarterly performance reflected robust revenue growth, furthering investor interest.

- Global Market Trends: External factors such as raw material prices and global economic conditions also play a significant role in influencing the share price.

Market Reaction and Investor Sentiment

Investor sentiment surrounding Mazagon Dock has been largely optimistic, especially following recent announcements regarding new orders and expansion plans. Analysts believe that MDL is well-positioned to benefit from India’s defense procurement plans, which aim to bolster indigenous production capabilities.

Conclusion and Future Outlook

In conclusion, while the current share price of Mazagon Dock reflects a positive growth trajectory, potential investors should remain cautious and consider the inherent risks associated with stock trading. Analysts recommend keeping an eye on government spending on defense, as well as the company’s upcoming financial results, which could offer clearer insights into the future direction of the share price. With ongoing developments in the defense sector, the performance of Mazagon Dock could hold significant implications for investors looking to capitalize on India’s growing focus on defense modernization.