Maruti Share Price: Current Trends and Market Analysis

Introduction

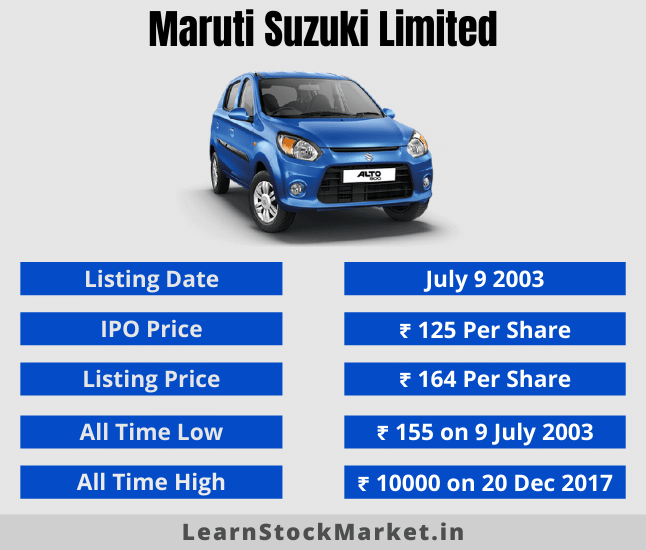

The share price of Maruti Suzuki India Ltd, a leading player in the Indian automotive market, is a focal point for investors and market analysts alike. As India’s largest car manufacturer, changes in Maruti’s share price offer insights not only into the company’s performance but also into the overall health of the automotive sector in India. With recent fluctuations in market conditions, understanding Maruti’s share price trends becomes vital for stakeholders.

Current Market Performance

As of October 2023, Maruti’s share price has shown notable volatility, influenced by various factors including global semiconductor shortages, shifts in consumer demand, and government policy changes regarding electric vehicles (EVs). Currently, Maruti shares are priced around INR 9,500, which represents a significant increase compared to the previous quarter’s average of INR 8,200.

Analysts attribute this growth to a robust post-COVID recovery in the automotive sector, alongside Maruti’s continuous innovation and expansion in the EV space. The company’s recent launches, including hybrid and electric models, have also contributed positively to investor sentiment.

Investment Insights

Investors are keenly observing Maruti’s strategic moves to enhance its production capabilities and sustainability initiatives. The company’s plans to invest INR 10,000 crores in electric vehicle development over the next few years have sparked optimism among investors. Additionally, the anticipated rollout of new models this year is expected to boost sales further, making Maruti a compelling option for long-term investors.

Conclusion

In conclusion, Maruti’s share price remains a critical indicator within the Indian stock market. While recent performance shows a positive upward trend, investors should consider external factors such as global supply chain issues and changing consumer preferences that may affect the company’s future valuation. As Maruti continues its expansion into electric mobility, stakeholders are likely to keep a close eye on its share price movements, forecasting potential growth amidst evolving market dynamics.