Market Analysis: Godfrey Phillips Share Price Updates

Importance of Godfrey Phillips Share Price

The Godfrey Phillips India Ltd. (GPI), a key player in the tobacco industry, has been under watch for its share price performance, especially amid varying market conditions. Investors and stakeholders closely monitor share prices as they reflect the company’s financial health and investor sentiment.

Recent Performance and Influencing Factors

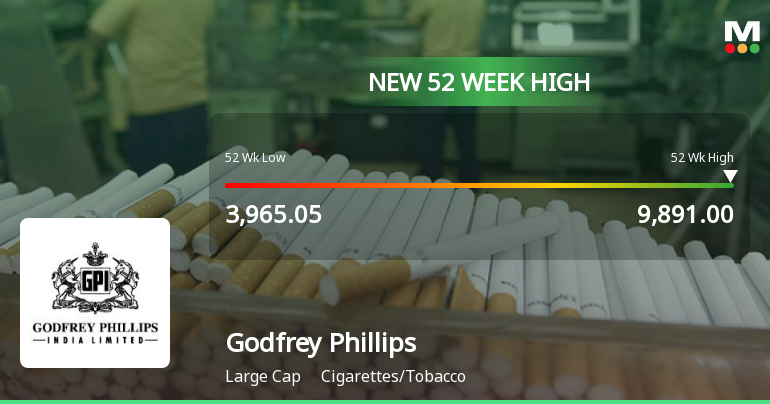

As of October 2023, Godfrey Phillips shares are trading at approximately ₹1,065, showing a slight increase of 1.2% over the last month. This upward trajectory can be attributed to several factors, including the company’s quarterly results, strategic business decisions, and changes in market dynamics.

The recent quarterly report highlighted an increase in net revenue by 15% year-over-year, marking a significant rebound in consumer demand post-pandemic restrictions. Experts believe that the company’s investment in diversification of its product offerings has allowed it to capture a larger market share, thereby boosting investor confidence.

Market Reactions and Future Outlook

Analysts following Godfrey Phillips have noted a bullish sentiment among investors, with several firms upgrading their price targets in response to the company’s performance. According to a report by a leading financial consultancy, the stock may reach ₹1,200 in the next six months, contingent on continued revenue growth and effective management of costs.

However, market participants are advised to remain cautious given the uncertainties in the regulatory landscape surrounding the tobacco industry. Additionally, the ongoing conversation around health issues related to tobacco consumption could weigh heavily on the company’s future performance.

Conclusion

The share price of Godfrey Phillips India stands as a reflection of its market resilience and adaptive strategies. While recent growth trends are promising, potential investors should consider both market opportunities and risks. Keeping an eye on regulatory developments and the company’s engagement in socially responsible practices may provide further insights into its long-term sustainability in the changing market dynamics.