Manappuram Share Price: Current Trends and Analysis

Introduction

Manappuram Finance, a prominent Indian non-banking financial company, has garnered significant attention from investors due to its performance in the stock market. The share price of Manappuram is a critical indicator of the company’s financial health and investor confidence. In this article, we explore the recent fluctuations in Manappuram’s share price, the factors influencing these changes, and the implications for potential investors.

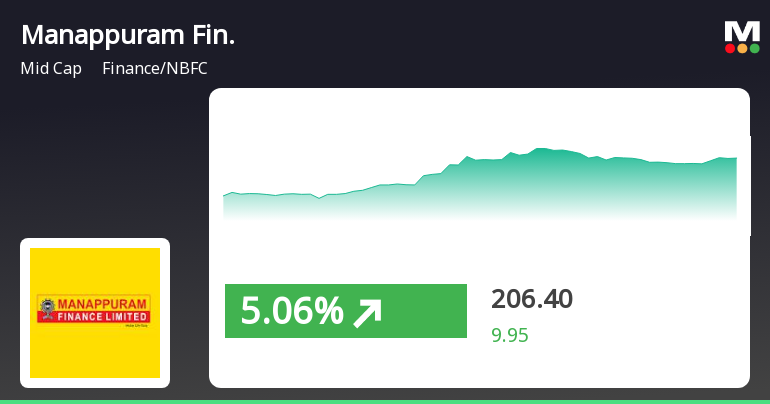

Current Share Price Trends

As of October 2023, Manappuram’s share price has seen considerable volatility, trading in the range of ₹120 to ₹135 during the last month. After experiencing a dip due to broader market corrections, the stock has shown signs of recovery, driven primarily by improved quarterly earnings reports and a bullish sentiment in the gold loan sector, which is Manappuram’s primary business area.

Events Influencing Share Price

A number of recent events have impacted the Manappuram share price:

- Q2 Earnings Results: The latest earnings report indicated a 20% increase in profit year-on-year, which positively influenced investor sentiment.

- Regulatory Changes: The Reserve Bank of India’s easing of certain lending restrictions has allowed for more competitive offerings in gold loans, leading to increased demand.

- Market Conditions: Fluctuations in gold prices have a direct impact on Manappuram’s business, with rising gold rates boosting loan demand.

Expert Opinions

Financial analysts remain cautiously optimistic about Manappuram’s future prospects. Many suggest that if the company continues to innovate its offerings and leverage technological advancements, it could stabilize its share price and attract more investors. However, they caution that external factors like inflation and global economic trends could pose risks going forward.

Conclusion

In conclusion, the Manappuram share price reflects broader patterns in the financial and economic landscape of India, particularly within the gold loan sector. For potential investors, keeping an eye on the company’s performance, industry developments, and market conditions will be crucial. Overall, while there are promising signs for Manappuram Finance, it is essential to approach investments with a well-informed strategy to navigate the complexities of the stock market.