Lupin Share Price: Current Trends and Market Insights

Introduction

The share price of Lupin Limited, one of India’s largest pharmaceutical companies, plays a crucial role in the financial markets, particularly in the healthcare sector. As the company continues to expand its global footprint, understanding its stock performance becomes increasingly important for investors, analysts, and stakeholders alike. This article explores the recent trends in Lupin’s share price and offers insights into the factors affecting its valuation.

Current Market Performance

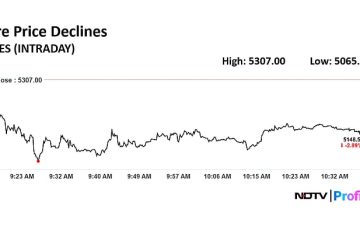

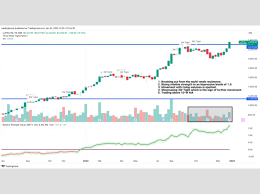

As of the end of October 2023, Lupin’s share price has witnessed significant fluctuations. Trading around ₹800, the stock has shown resilience despite challenges in the pharmaceutical industry, including regulatory hurdles and pricing pressures. In the past month, the share price experienced a low of ₹750 and a high of ₹830, reflecting the volatility inherent in the sector.

Factors Influencing Lupin’s Share Price

Several factors contribute to the movement of Lupin’s share price:

- Global Market Dynamics: The pharmaceutical industry is heavily influenced by global market conditions, including demand for generic drugs, supply chain issues, and changes in healthcare regulations.

- Financial Performance: Strong quarterly earnings reports can boost investor confidence. Lupin’s recent earnings report showed a 5% increase in revenue driven by strong sales in the U.S. market and a robust pipeline of new drugs.

- Competition: The increasing competition in the pharmaceutical space from both domestic and international companies affects market sentiment regarding Lupin’s market share and profit margins.

Recent Developments

In recent weeks, Lupin has announced partnerships aimed at enhancing its research and development capabilities. This strategic move is expected to bolster its portfolio with new innovative drugs, potentially driving future growth. Moreover, the company has made advancements in biosimilars, which are predicted to be a significant growth area moving forward.

Conclusion

Predicting the share price of Lupin requires careful consideration of market trends, company performance, and external factors. Given its strong financial position and strategic initiatives, analysts remain cautiously optimistic about the future trajectory of Lupin’s share price. For investors, staying updated on industry trends and company news is essential for making informed decisions. As Lupin navigates challenges and opportunities, its stock will remain a topic of interest in the Indian pharmaceutical sector.