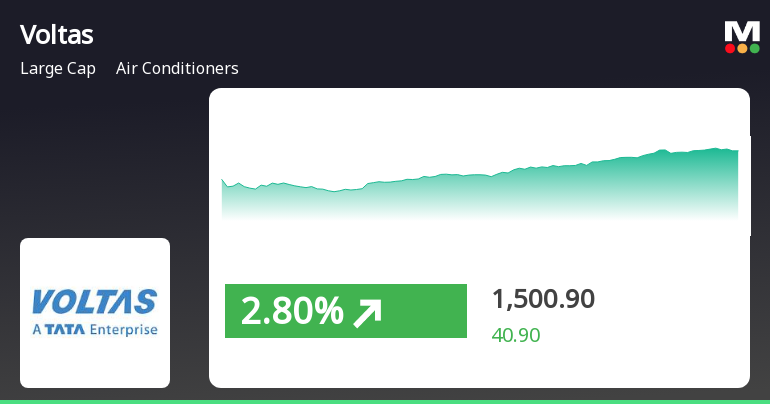

Latest Updates on Voltas Share Price

Introduction

The Voltas share price has been a focal point of interest among investors, particularly as the company navigates through a dynamic market in 2023. With significant developments in both the air conditioning industry and the broader Indian economy, understanding the fluctuations in Voltas’ stock is crucial for potential investors and industry enthusiasts.

Current Market Trends

As of October 2023, Voltas, a leading name in the air conditioning and engineering sector, has experienced notable movements in its share price. The stock was trading at approximately INR 750, reflecting a rise of about 5% over the last month. Analysts attribute this increase to a combination of factors, including strong earnings reports and renewed interest in consumer goods amid an economic recovery.

Factors Influencing Voltas Share Price

Several factors continue to influence Voltas’ share price significantly. Firstly, the company’s recent quarterly performance showcased a 20% increase in revenue compared to the previous year, largely due to escalating demand for cooling solutions following record-high temperatures in various regions across India.

Moreover, the company’s investments in expanding its product line, including energy-efficient models and smart technology appliances, have also garnered investor attention. These innovations not only meet market demands but also align with governmental initiatives focusing on sustainability and energy efficiency.

Market Predictions

Looking forward, market analysts predict that the Voltas share price could remain volatile, especially with factors such as inflation, fluctuating raw material costs, and competitive pressures in the HVAC industry influencing financial performance. However, many experts remain optimistic, anticipating further growth as the company expands its market reach and continues to innovate.

Conclusion

In conclusion, the Voltas share price is not merely a reflection of the company’s past performance but also a crucial indicator of future potential within a recovering economy. Investors should remain attentive to market trends, economic recovery signals, and the company’s strategic initiatives to gauge the longevity of its upward trajectory. As always, it is crucial for investors to conduct thorough research and consider both the risks and opportunities presented by the stock.