Latest Updates on Tata Motors Share Price

Introduction

Tata Motors, one of India’s largest automotive manufacturers, has seen significant fluctuations in its share price over recent months. As a key player in the automotive industry, the company’s share performance is closely monitored by investors and analysts alike. Understanding these dynamics is crucial for investors looking to make informed decisions amid ongoing market changes influenced by global and local economic conditions.

Current Trends in Tata Motors Share Price

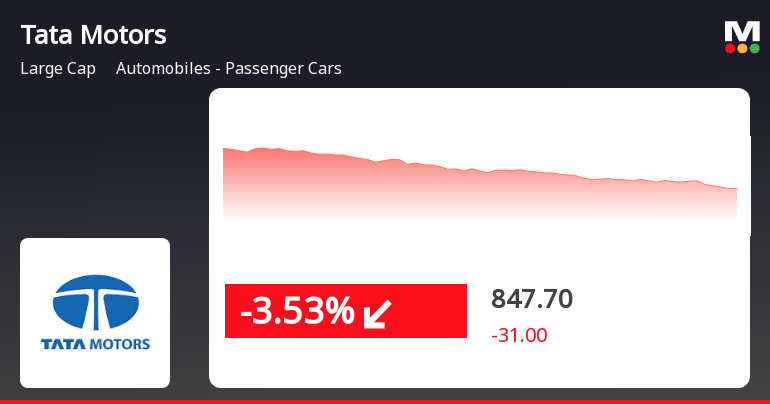

As of October 2023, the Tata Motors share price is approximately ₹550, reflecting a recent uptrend partially spurred by positive quarterly earnings reports. The company has managed to post a profit of ₹1,500 crores in Q2 FY2023, significantly higher than previous quarters. Analysts attribute this improvement to a robust recovery in demand for electric vehicles (EVs) and the overall resurgence of the automobile sector after the pandemic-induced slowdown.

Market Reactions and Influencing Factors

Market analysts point out several factors influencing Tata Motors’ stock performance:

- Strong EV Portfolio: Tata Motors has established itself as a leader in the EV space in India, with successful models like the Tata Nexon EV and the Tigor EV generating significant sales volume.

- Global Supply Chain Resilience: The company has focused on stabilizing its supply chain which will aid in maintaining production levels and fulfilling increased orders.

- International Presence: Expansion in international markets, particularly in Europe, has bolstered investor confidence, as the global demand for sustainable transport grows.

Conclusion

In summary, the Tata Motors share price is on an upward trajectory, reflecting the company’s strategic improvements and growing demand for its offerings. Investors are advised to keep a close watch on market trends and company announcements as they can significantly affect share movements. With the automotive sector still in flux due to factors like changing consumer preferences and economic conditions, the future of Tata Motors remains promising, yet warrants careful observation. Ensuring a well-informed portfolio can help investors leverage the evolving landscape in the automotive industry.