Latest Updates on South Indian Bank Share Performance

Introduction

South Indian Bank, a prominent player in the banking sector of India, has recently garnered attention from investors due to its fluctuating share prices. The bank, which has a significant presence in southern India, is not just a banking institution but a critical player in the region’s economic landscape. Understanding the current performance of South Indian Bank shares is essential for both existing and potential investors as market trends sharply influence their portfolio decisions.

Recent Performance of South Indian Bank Shares

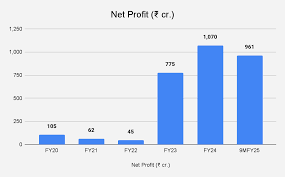

As of October 2023, South Indian Bank’s share price has shown notable volatility, reflecting broader trends in the financial sector. Data from the National Stock Exchange indicates that the stock has experienced a considerable rise of approximately 20% in the past quarter, following quarterly earnings that exceeded market expectations. In its latest financial report, the bank reported a net profit growth of 30% year-on-year, buoyed by increased net interest income and improved asset quality.

Market analysts attribute this positive change partially to the bank’s strategic initiatives, like enhanced digital banking services and a focused approach on improving customer reach. Furthermore, the bank has also been actively working to reduce its non-performing assets (NPAs), which has led to improved investor confidence.

Market Experts Weigh In

Financial analysts have shared mixed forecasts regarding the future of South Indian Bank shares. Some experts believe that the bank is positioned for further growth, particularly as it expands its digital footprint and leverages technology to attract younger customers. However, others caution investors to remain vigilant about market conditions that could impact bank stocks.

In a recent report, Care Ratings expressed optimism about South Indian Bank’s fundamentals but advised investors to monitor macroeconomic indicators closely. The Reserve Bank of India’s stance on interest rates, inflation, and overall economic recovery is likely to impact the performance of all banking shares, including South Indian Bank.

Conclusion

The South Indian Bank share presents a mix of opportunities and risks for investors. As the bank continues to implement growth strategies and improve its financial health, its share price may reflect these efforts positively. However, with economic conditions being a critical factor, it is crucial for investors to keep abreast of market trends and macroeconomic signals. Overall, South Indian Bank continues to be a noteworthy contender in the Indian banking sector, making its shares an important consideration for both short-term and long-term investors.