Latest Updates on Rites Share Price

Introduction

The share price of RITES Limited, a prominent player in the Indian infrastructure sector, has garnered significant attention among investors and market analysts alike. As a state-owned enterprise, RITES plays a critical role in the development of transportation infrastructure in India, encompassing railways, highways, and urban transit systems. Fluctuations in its share price reflect the broader economic conditions and government initiatives towards infrastructure growth, making it a key stock to watch.

Current Market Trends

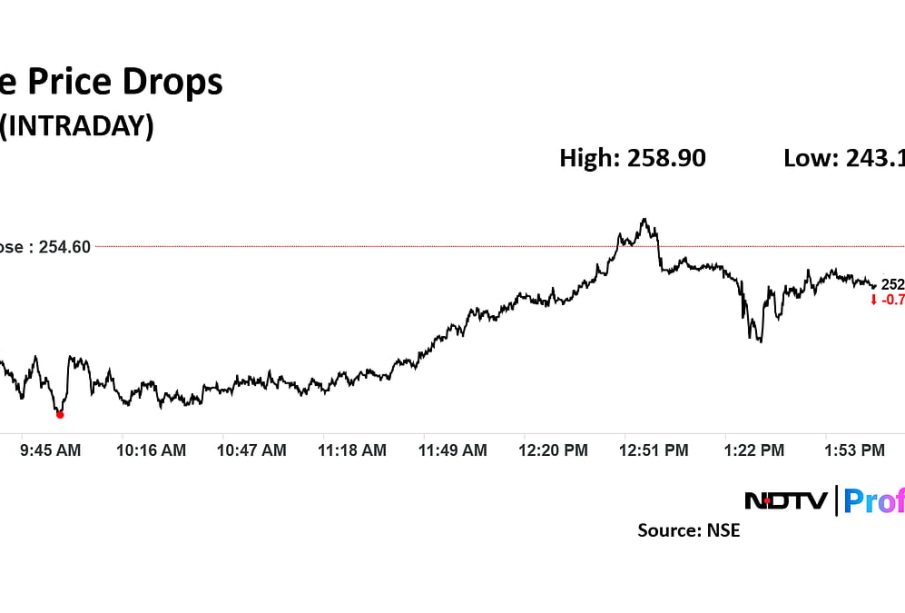

As of the latest trading session, RITES’ share price has reached INR 295, showing a modest increase of 1.5% from the last closing price. This uptick can be attributed to positive investor sentiment following recent announcements about upcoming government projects in rail and road development. In the past month, RITES’ share price has experienced a stable upward trend, recovering from lows earlier this year due to market volatility driven by geopolitical tensions.

Recent Developments

RITES has been awarded multiple contracts for railway modernization and station redevelopment, which are expected to boost its revenues significantly. The company’s recent quarterly earnings report showed an increase in net profit by 35%, attributed to its diversified portfolio and robust order book. Analysts anticipate that sustained government focus on infrastructure, especially with major project approvals expected in the union budget, will continue to support RITES’ share price growth.

Future Outlook

Looking ahead, experts predict that RITES’ share price may experience further appreciation, particularly as more infrastructure projects are rolled out in 2024. The company’s capability to secure and execute contracts efficiently will be critical to its stock performance. However, investors are advised to monitor external factors such as interest rate changes and global economic conditions that may influence market dynamics.

Conclusion

In summary, RITES Limited stands at an interesting juncture, with its share price reflecting strong fundamentals and the positive outlook for India’s infrastructure sector. Investors should keep an eye on RITES’ strategic decisions and government policy announcements to make informed investment choices moving forward. As infrastructure continues to be a priority for the Indian government, RITES is well-positioned for growth in the coming years.