Latest Updates on RBL Bank Share Price

Introduction

RBL Bank, one of India’s prominent private sector banks, has been in the news lately due to fluctuations in its share price. Understanding the implications of these changes is crucial for investors and stakeholders as it reflects the bank’s financial health and market perception. In this article, we will delve into the recent trends in RBL Bank’s share price, their possible causes, and what they signify for the future.

Recent Share Price Trends

As of October 2023, RBL Bank’s share price has shown significant volatility. In the last month, the stock has hovered between ₹180 to ₹220, driven by a mix of market sentiment and internal performance metrics. Analysts attribute some of this fluctuation to the bank’s quarterly results, which revealed a growth in net interest income, a positive signal for investors. However, concerns about asset quality and non-performing assets (NPAs) have clouded investor sentiment, contributing to the price swings.

Key Events Influencing Share Price

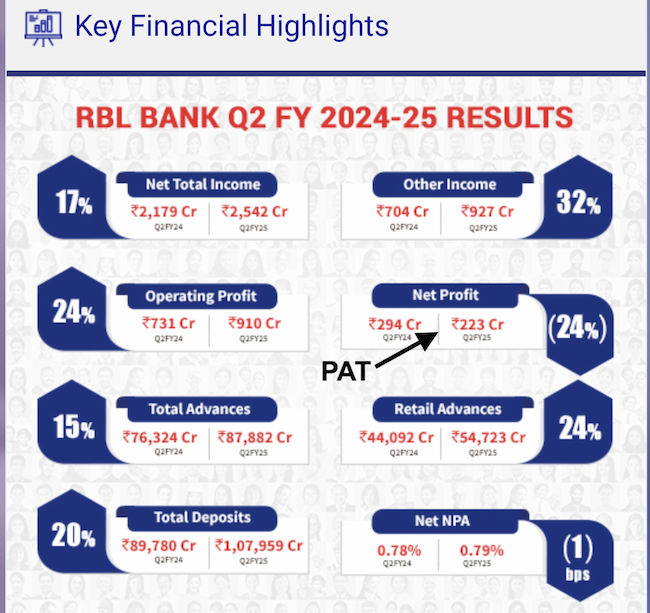

Several key events have influenced the share price of RBL Bank recently. The announcement of their quarterly earnings report provided a mixed bag of results. While the bank reported an increase in profit compared to the same quarter of the previous year, it also faced scrutiny over rising NPAs which raised concerns among investors. Moreover, the Reserve Bank of India’s recent monetary policy, which has maintained a steady interest rate, has implications for the bank’s lending operations and profitability, further affecting share prices.

Market Sentiments and Analysts’ Opinions

Market analysts have varying opinions on RBL Bank’s future in the stock market. Some analysts have a bullish outlook, citing strong fundamentals and a potential for recovery due to diversification of their loan portfolio. Others caution that if asset quality issues persist, it may undermine overall profitability, thereby keeping the share price under pressure. The recent trend shows that investor sentiment is closely tied to broader economic indicators and the bank’s operational efficiency.

Conclusion

In conclusion, RBL Bank’s share price is currently a reflection of both its operational success and the challenges it faces in asset management. For current and potential investors, the coming months are critical as they will reveal whether the bank can navigate these challenges effectively. Analysts suggest keeping an eye on quarterly results and broader economic signals before making investment decisions. As the banking sector adapts to changes, RBL Bank’s strategy and performance in the next few quarters will be pivotal in determining its stock’s trajectory.