Latest Updates on Kotak Bank Share Price

Introduction

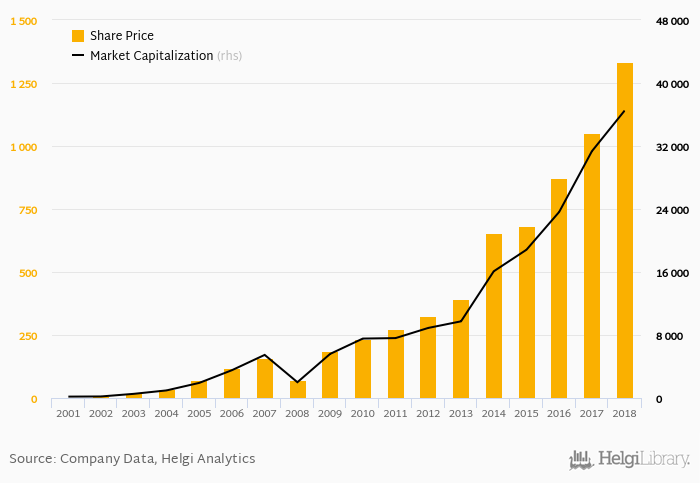

The stock market plays a vital role in the economic landscape of India, and understanding the movement of bank shares is pivotal for investors. Kotak Mahindra Bank, one of India’s premier banking institutions, has been a key player in this sector. As of October 2023, following recent financial results and economic developments, tracking its share price has become increasingly important for investors and financial analysts alike.

Current Situation of Kotak Bank Share Price

As of the latest trading session, Kotak Bank’s share price has shown notable fluctuations. On October 20, 2023, shares of Kotak Mahindra Bank traded around ₹1,900, a slight increase from its previous close, driven by robust quarterly results that exceeded market expectations. The bank reported a net profit increase of 15% year-on-year, attributed to improved asset quality and increased net interest income.

Market analysts have observed that the bank’s performance in retail and corporate loans has supported the growth in both revenue and profit margins. However, the rising competition from fintech and digital banking has kept pressure on traditional banks, including Kotak Mahindra. Investors are particularly watching how the management plans to navigate these challenges in the coming quarters.

External Factors Affecting Share Price

External market conditions, such as inflation rates and RBI monetary policies, also play a crucial role in determining the share price of Kotak Bank. The Reserve Bank of India’s recent decision to maintain the repo rate has been seen as a stabilizing factor for banks, which could positively influence their stock prices moving forward.

Moreover, investor sentiment has also been buoyed by overall market trends, with the banking sector expected to grow due to the revival of economic activities post-pandemic. This positive outlook could lead to further stability and potential growth in the share price of Kotak Mahindra Bank.

Conclusion

The Kotak Mahindra Bank share price continues to be influenced by a mix of internal performance metrics and broader economic factors. For short-term investors, monitoring quarterly performance reports and macroeconomic indicators will be crucial to make informed decisions. Long-term investors, on the other hand, may take comfort in the bank’s strategy and historical performance. As the bank adapts to the evolving financial landscape, its share price trajectory remains a topic of interest, with expectations of moderate growth in the upcoming quarters.