Latest Updates on KIOCL Share Price

Importance of Monitoring KIOCL Share Price

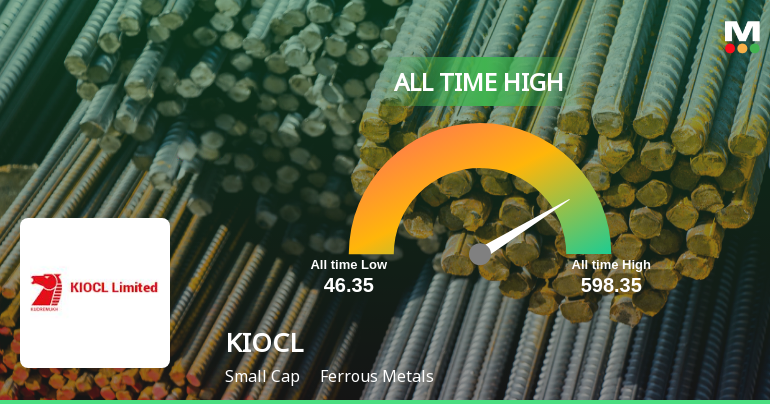

The share price of KIOCL (Kudremukh Iron Ore Company Limited) is not only a crucial indicator of the company’s financial health but also reflects the broader trends in the iron ore industry. Investors and stakeholders closely watch these movements as they can greatly influence investment decisions. As India continues to push for infrastructure development, the demand for iron ore remains a key driver for companies like KIOCL.

Current Market Performance

As of the latest data in October 2023, KIOCL’s shares have shown significant volatility. The current share price stands at ₹165, reflecting a slight decrease of 2% from the previous week due to concerns about global iron ore supply fluctuations and the impact of recent economic policies. Over the past three months, the stock has experienced ups and downs, peaking at ₹180 before dipping again. Analysts attribute this to changing demand patterns influenced by ongoing construction projects and the potential for regulatory changes in mining policies.

Factors Influencing KIOCL Share Price

Several factors contribute to fluctuations in KIOCL’s share price. Firstly, global iron ore prices have been affected by international trade dynamics, particularly with major miners in Brazil and Australia. Additionally, the recent monsoon season has impacted mining operations, which in turn affects production forecasts for KIOCL. Furthermore, government initiatives to boost domestic manufacturing and the overall economic environment in India play a significant role in shaping investor sentiment.

Future Outlook

Looking ahead, analysts are cautiously optimistic about KIOCL’s potential. The central government’s continued focus on infrastructure projects could lead to increased demand for iron ore, supporting KIOCL’s growth ambitions. Market experts suggest that investors should keep an eye on quarterly earnings reports and global market conditions as these will heavily influence the share price in the coming months. Overall, while there are short-term challenges, the long-term outlook could be positive if global conditions stabilize and P.M. Modi’s initiatives bear fruit.

Conclusion

The KIOCL share price remains a key point of interest for investors amid changing market conditions. Continuous monitoring of global iron ore trends and domestic policy changes will be essential for making informed investment decisions. With potential for growth tied to national infrastructure projects, KIOCL could present valuable opportunities for savvy investors willing to navigate the current market dynamics.