Latest Updates on Hindustan Copper Share Price

Introduction

Hindustan Copper Limited (HCL) has been a significant player in the Indian mining and metallurgical sector since its inception in 1967. As the government continues to push for increased mineral production and infrastructure development, the share price of HCL is of great interest to investors and analysts alike. Understanding the fluctuations in the company’s stock can provide insights into the broader trends in the mining industry and the Indian economy.

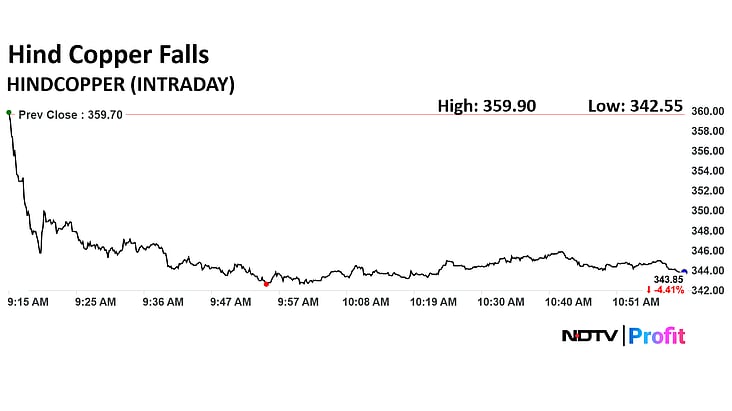

Current Share Price Trends

As of October 25, 2023, Hindustan Copper’s share price stands at ₹120 per share, reflecting a moderate increase of 2.5% over the past week. The company’s stock has demonstrated resilience amidst fluctuations in the broader market, which has seen several ups and downs due to global economic uncertainties. For example, the copper prices in international markets have bounced back, driven by increased demand from infrastructure projects in various countries, particularly in Asia.

Factors Influencing Share Price

Several factors are currently influencing Hindustan Copper’s share price:

- Global Copper Prices: Copper is essential in various industries including construction and electric vehicles. Recent demand recovery has positively affected stock prices.

- Government Policies: The Indian government’s focus on mining reforms and infrastructure development is expected to enhance HCL’s production capabilities.

- Financial Performance: HCL reported a net profit of ₹200 crore in the last quarter, showcasing a substantial increase compared to the previous year.

- Environmental Concerns: Ongoing initiatives to improve sustainable mining practices can impact investor sentiment and stock performance.

Outlook for Investors

Analysts remain cautiously optimistic regarding Hindustan Copper’s stock. The company is well-positioned to benefit from rising copper prices, and potential policy shifts favoring mining can lead to long-term growth. However, investors are advised to keep an eye on global economic conditions, regulatory changes, and commodity price volatility, which can significantly impact share performance.

Conclusion

In conclusion, Hindustan Copper’s share price is influenced by multiple interconnected factors, including global market dynamics and domestic policies. With an encouraging uptick in stock value recently, investors might find opportunities in this industrial stalwart. Always consider comprehensive market analysis and consult financial advisors for tailored investment strategies.