Latest Updates on HEG Share Price

Introduction

Understanding the movements of a company’s share price is crucial for investors, analysts, and stakeholders. Today, we take a close look at HEG Limited, a prominent player in the graphite products market, especially as its shares reflect the overall investor sentiment in the sector. Recent events have significantly impacted the HEG share price, making it an important area for financial examination.

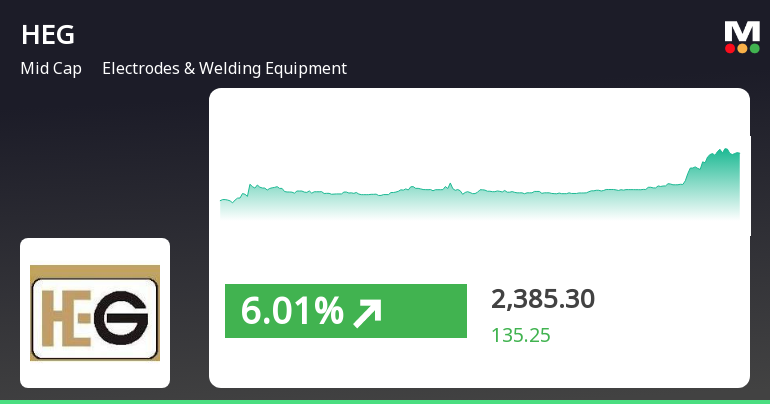

Recent Trends in HEG Share Price

As of mid-October 2023, HEG’s share price has shown a volatile trend. The stock was valued at approximately INR 1,800 at the beginning of the month, but due to a variety of factors, including global graphite demand fluctuations and geopolitical influences, the share price has experienced both rises and declines. By October 15th, the share price trend indicated a low of INR 1,740 before revisiting the INR 1,800 mark following positive quarterly results announced by the company.

Factors Influencing the Share Price

Several factors affect HEG’s share price. Firstly, the demand for graphite electrodes, which are crucial in steel production, plays a significant role. With the recovery of global industrial activities post-pandemic, there has been a sustained demand for graphite products, positively influencing HEG’s stock value. Additionally, fluctuations in global commodity prices and trade tariffs can impact production costs and consequently the share price.

Moreover, HEG’s recent investments in expanding production capacity and improving operational efficiencies have contributed positively to investor sentiment, evidenced by a mild recovery in share price amid economic uncertainties.

Market Analysts’ Perspectives

Market analysts remain cautiously optimistic about HEG’s future. Some analysts project that if the company continues to leverage its production capabilities effectively and the demand for graphite products does not wane, the share price could see a gradual increase. However, potential investors are advised to stay informed about market conditions and trends in demand, as these will be critical in determining future price movements.

Conclusion

The HEG share price is reflective of broader market trends and company performance. As of now, the shares remain an interesting option for investors interested in the materials sector, particularly those focused on the growth potential linked to clean technologies and sustainability. Keeping an eye on HEG’s quarterly performance, market conditions, and geopolitical factors will provide insights into the future trajectory of the share price, making it a compelling element to watch in the upcoming months.