Latest Updates on Dmart Share Price in 2023

Introduction

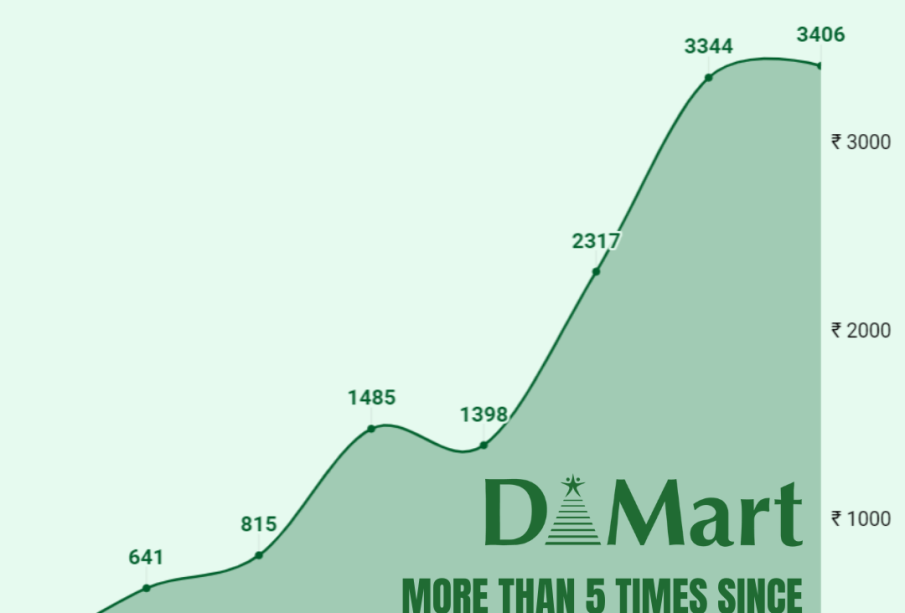

Dmart, officially known as Avenue Supermarts Limited, has been making waves in the Indian stock market since its initial public offering (IPO) in 2017. With its strong business model, rapid expansion, and customer-centric approach, the company’s share price holds significant importance for investors and market analysts. Understanding the trends and factors influencing Dmart’s share price is crucial for making informed investment decisions.

Current Performance of Dmart Share Price

As of mid-October 2023, Dmart shares are trading around ₹3,700, a notable rise of approximately 15% year-to-date. This surge can be attributed to several factors, including consistent sales growth, expansion into new territories, and a robust strategy to enhance customer experience. The company reported a 20% increase in revenue in the last quarter, leading to investor optimism.

Factors Influencing Share Price

- Expansion Plans: Dmart has been aggressively expanding its footprint across India, opening new stores in tier 2 and tier 3 cities. This strategy not only increases its customer base but also bolsters its revenue streams.

- Consumer Trends: With the rise of organized retailing in India, Dmart is well-positioned to capture the growing demand for affordable grocery options. Its focus on value for money has resonated well with shoppers.

- Market Sentiment: Recent positive market sentiment towards the retail sector, driven by a recovering economy post-pandemic, has further buoyed Dmart’s share price.

Future Outlook

Analysts are optimistic about Dmart’s future performance. Given the company’s historical growth trajectory and market strategies, many predict that the stock could continue to rise, potentially reaching or surpassing the ₹4,000 mark by the end of the year. Investors are advised to monitor quarterly results and market conditions closely to make timely investment decisions.

Conclusion

The Dmart share price remains a beacon of interest for investors in the Indian equity market. Its robust growth, driven by strategic expansion and consumer-focused practices, highlights the company’s resilience and potential for future value creation. As always, potential investors should conduct thorough research and consider various market factors before investing.