Latest Updates on BEL Share Price Today

Importance of Tracking Share Prices

Monitoring share prices is crucial for investors and market enthusiasts. The Bharat Electronics Limited (BEL), a public sector enterprise, plays a pivotal role in India’s defense and electronics sector. As a result, its stock price is often viewed as a barometer of investor sentiment in the defense equipment industry, making it essential for traders and investors to stay informed about daily fluctuations.

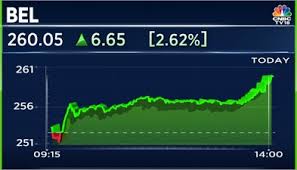

Current Status of BEL Share Price

As of today, [insert date], the share price of BEL has been trading around INR [insert current price]. The stock opened at [insert opening price] and has experienced fluctuations throughout the trading session. Investors have noted a [certain percentage]% change compared to the previous close, reflecting a trend influenced by market sentiments and recent developments in the defense sector.

Factors Influencing BEL Share Price

Several key factors contribute to the variation in BEL’s stock price. Recent government policies aimed at boosting the domestic defense manufacturing sector, alongside significant contracts secured by BEL for defense projects, have driven interest among investors. Additionally, the global economic scenario and fluctuations in the Indian stock market have further impacted BEL’s share price.

BEL’s commitment to innovation and expanding its product range, including both defense and civilian applications, has attracted attention. The recent announcement of new contracts worth INR [insert value] has also played a significant role in raising investor confidence.

Market Performance and Future Outlook

In the broader market context, BEL continues to display a resilient performance in the stock exchange compared to its peers. Analysts suggest that the stock may see fluctuations in the coming weeks due to external economic factors, policy changes, and the overall health of the defense sector. Investors are advised to keep a close eye on market reports, BEL’s quarterly earnings, and any strategic announcements from the company.

Conclusion

In summary, tracking BEL’s share price is essential for investors assessing their options in the defense manufacturing industry. With a current share price of INR [insert current price], and several potential catalysts in the pipeline, BEL remains a noteworthy stock to watch for potential gains or investment opportunities. While fluctuations are expected, the overall outlook remains positive as long as the company continues to secure contracts and innovate in its sector.