Latest Updates on Avanti Feeds Share Price

Introduction

The share price of Avanti Feeds, a key player in the aquaculture and shrimp feed industry in India, has garnered significant attention from investors recently. As one of the foremost companies in this sector, understanding the dynamics of its share price is crucial for stakeholders and potential investors. With fluctuating market conditions and changing demand in the aquaculture sector, keeping abreast of Avanti Feeds’ stock performance is more relevant than ever.

Current Trends in Avanti Feeds Share Price

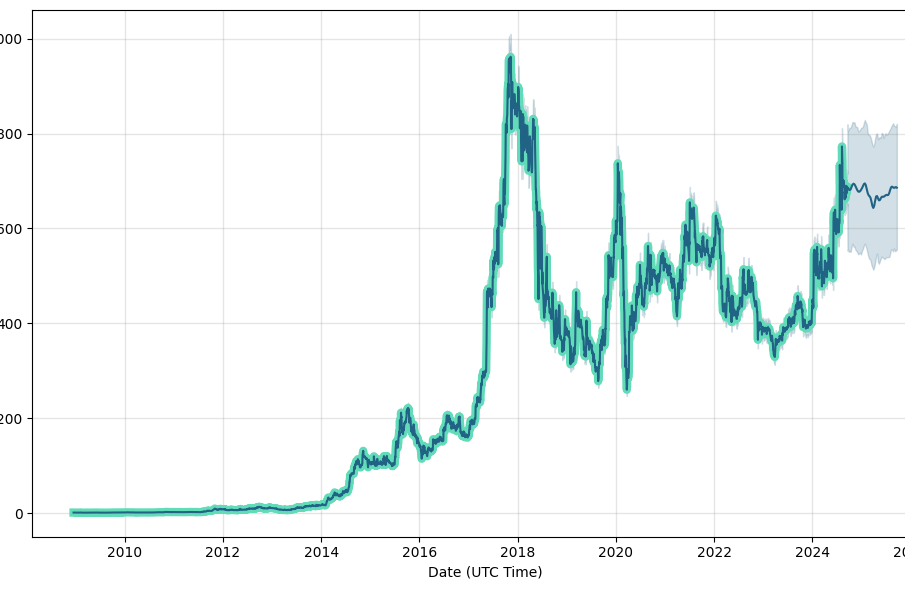

As of the latest trading sessions in October 2023, Avanti Feeds’ share price has shown volatility reflective of broader market trends. After experiencing a dip earlier in the month due to concerns over fluctuating feed input costs and seasonal demand, the stock has started to regain some of its value. Recent reports indicate that the share price is hovering around INR 480, having slowly recovered from its previous lows.

The company’s Q2 earnings report, which was released earlier this month, indicated a marginal increase in revenue versus previous quarters, fostering positive sentiments among investors. Analysts predict that a stable demand in the shrimp export market, coupled with improved operational efficiencies, could bolster the share price further in the coming months.

Market Influences and Future Projections

Several factors are influencing the fluctuations in Avanti Feeds’ share price. Key among them is the global demand for shrimp and seafood, which has been significantly affected by both domestic and international markets recovering post-pandemic.

Additionally, the company’s plans for expansion and diversification into organic feed products are anticipated to attract a new customer base and offer growth potential. Likewise, ongoing government initiatives supporting the aquaculture sector and investments in infrastructure could provide further tailwinds to the company’s operations.

Conclusion

For investors and market analysts, staying informed about Avanti Feeds’ share price movements is essential, given its significance in the agribusiness sector in India. With key earnings reports and market conditions shaping the future, the company’s stock performance could present valuable opportunities for investment. Observers are optimistic that as demand stabilizes and the economic environment improves, Avanti Feeds can reclaim a stronger position in the market, making now a critical time for stakeholders to closely monitor its share price trajectory.