Latest Update on JWL Share Price

Introduction: The Importance of JWL Share Price

The stock market plays a crucial role in the economy, serving as a barometer for the performance of companies and investor sentiment. Among the many stocks traded on the market, JWL (Jewellery World Limited) has garnered significant attention recently due to its fluctuating share price and overall market performance. Understanding the trends surrounding JWL’s share price is vital for investors, industry analysts, and anyone interested in the jewellery sector.

Current Trends and Market Analysis

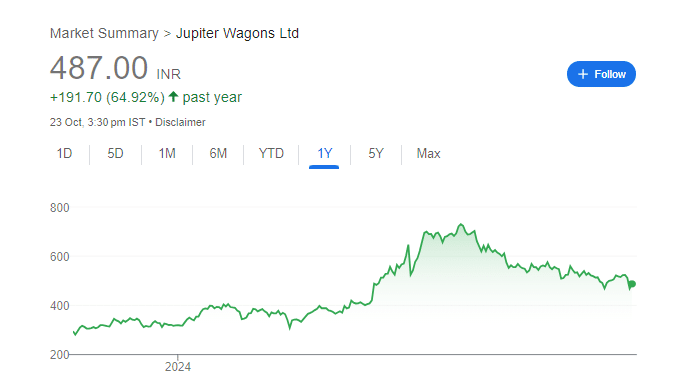

As of the latest trading session, JWL shares are currently valued at ₹350, experiencing a moderate increase of 2% from the previous week. Analysts have attributed this rise to several factors, including increased consumer demand for luxury items as inflation stabilizes, and a recent marketing campaign that has effectively boosted the brand’s visibility. Over the past month, JWL has shown a steady uptrend, with a 5% increase, suggesting a positive response from investors amid challenging economic conditions.

However, the company also faces challenges. A recent report highlighted that while sales have been robust, rising raw material costs could impact profit margins. The global market for gold and diamonds has seen price fluctuations, which may affect JWL’s financial outlook in the coming quarters. Analysts believe that investors should closely monitor these factors when considering their investment in JWL shares.

External Factors Influencing JWL Share Price

Global events also play a significant role in the performance of JWL shares. For instance, the ongoing trade policies and tariffs affecting imported gemstones are a concern for the industry as a whole. Furthermore, the recent economic indicators signaling a potential recession could influence consumer behavior, especially in the luxury segment.

The company’s quarterly earnings report is expected to be released next month, which may provide further insights into JWL’s financial health and strategic direction. Analysts anticipate that the results will be closely watched by investors, likely leading to increased volatility in the share price.

Conclusion: What the Future Holds for JWL

In conclusion, while the current trends in JWL’s share price show promise, the company’s future performance will depend on various internal and external factors. Investors are advised to stay updated on market trends, economic indicators, and JWL’s strategic moves in the competitive jewellery market. As we look ahead, the potential for growth in JWL shares is significant, but it comes with inherent risks that each investor must weigh carefully.