Latest Update on JBM Auto Share Price

Introduction

JBM Auto, a prominent player in the Indian auto components sector, continues to attract investor attention with its innovative solutions in electric and conventional vehicles. As the automotive industry rapidly evolves towards sustainability, monitoring direct investment opportunities such as JBM Auto’s share price is crucial for both investors and market analysts. This post delves into recent trends and performance metrics associated with JBM Auto shares.

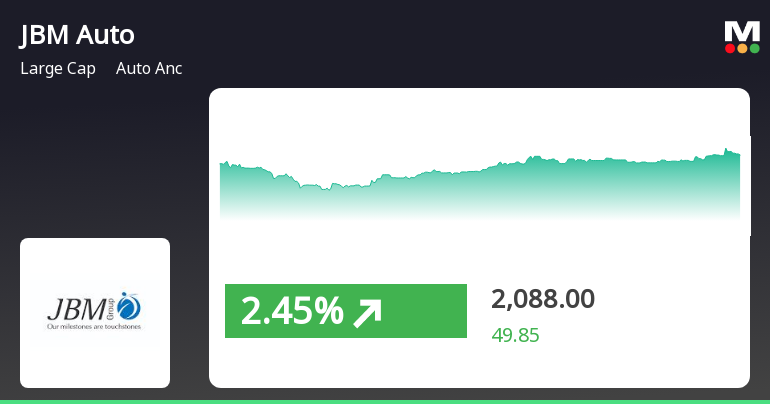

Recent Market Performance

As of October 2023, JBM Auto’s share price has shown remarkable fluctuations. Following a robust recovery post-pandemic, driven by increased demand for electric vehicles and government incentives, the stock has displayed a performance trajectory significantly outperforming the benchmark indices. Noteworthy, the share price surged to an all-time high of ₹750 recently, which marks a substantial increase of over 25% since the beginning of the fiscal year.

Factors Influencing the Share Price

Several factors are driving JBM Auto’s share price movement:

- Government Policy: The Indian government’s emphasis on electric vehicles under the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme has directly benefited JBM Auto, aligning with their strategic investment in EV technology.

- Corporate Developments: Recently, JBM Auto announced a joint venture with a leading global automaker, enhancing its market position and spurring positive investor sentiment. Introduction of new product lines focused on sustainable transportation has further bolstered confidence.

- Market Trends: As consumer preferences shift towards greener alternatives, the growth trajectory of JBM Auto’s product offerings in the electric segment shows promise that could sustain its share price in the long run.

Conclusion

With the automotive sector at the cusp of transformative change, JBM Auto’s share price is indicative of broader industry movements towards electrification and sustainability. Investors are advised to keep an eye on the company’s quarterly earnings, market expansions, and technological advancements, all of which will play critical roles in shaping the future of its stock performance. Continuous investment in tech-savvy production methods and partnerships also suggests a healthy growth forecast for the company, making it a potentially attractive option in the automotive equity market.