Latest Update on Dixon Technologies Share Price

Introduction

Dixon Technologies, a prominent player in the electronics manufacturing sector in India, has been a focal point for investors this year. As a key supplier of a variety of electronic goods, including LED TVs, appliances, and mobile phones, the company’s performance on the stock market is closely monitored. The volatility in share prices is crucial for traders and long-term investors alike, making it an important aspect of the current financial landscape.

Current Share Price and Market Performance

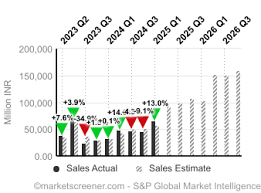

As of October 23, 2023, Dixon Technologies’ share price is estimated at ₹4,800, reflecting a significant appreciation compared to its price of ₹2,800 at the start of the year. The company’s robust growth trajectory can be attributed to its strategic partnerships and the increasing demand for electronic products in both domestic and international markets.

Recent financial reports showed a revenue growth of 20% year-on-year, which greatly contributed to the bullish sentiment among investors. Analysts agree that while the company faces challenges, such as global semiconductor shortages and supply chain disruptions, its innovative capabilities and diversification strategy allow it to navigate these hurdles effectively.

Future Prospects

Looking ahead, Dixon Technologies is set to benefit from the ongoing digital transformation across various sectors. The Indian government’s push for ‘Atmanirbhar Bharat’ (self-reliant India) initiatives has opened up more opportunities in local production and has potentially paved the way for increased investments in the electronics sector.

Market analysts predict that the share price could rise further, depending on the overall performance in Q3 2023 financial results and the company’s ability to meet production targets. Some experts suggest that the share price may reach as high as ₹5,500 by the end of the financial year if current trends continue.

Conclusion

In conclusion, Dixon Technologies continues to show remarkable resilience in an ever-changing market, making its share price a key indicator for investors. With strong financial fundamentals, promising market trends, and government support, investors are optimistic about the stocks. However, as with any investment, potential investors should conduct thorough research and consider market dynamics before making any decisions.