Latest Trends in Yes Bank Share Price

Introduction

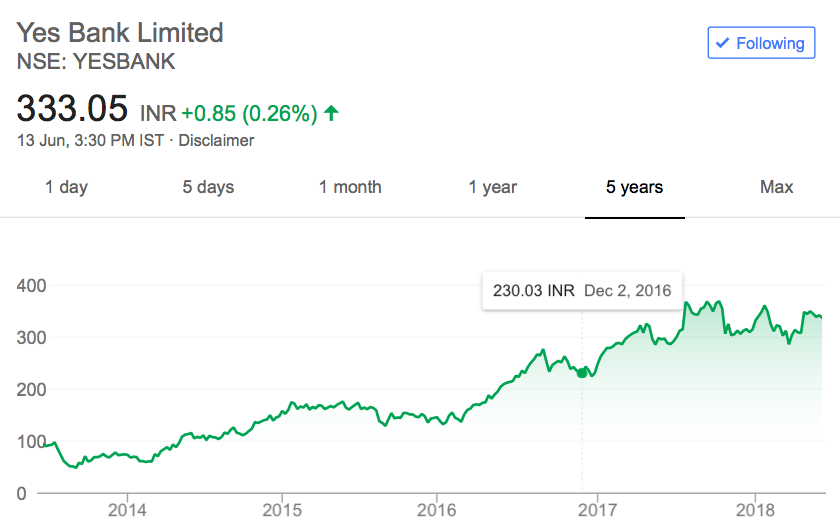

The share price of Yes Bank has become a point of considerable interest for investors and market analysts alike. As one of India’s prominent private sector banks, its financial performance and market trends are critical not only for stakeholders but also for the broader banking sector. Recently, the bank has experienced significant fluctuations in its stock price, prompting discussions on its future trajectory.

Recent Performance

As of late October 2023, Yes Bank’s share price has shown signs of recovery after a turbulent period. The stock closed at approximately ₹18.75 on October 25, reflecting a modest increase of around 2.5% over the previous week. Analysts attribute this upward movement to the bank’s ongoing restructuring efforts and improvement in asset quality. According to the bank’s latest quarterly report, the Net Non-Performing Assets (NPA) ratio has decreased to 3.3%, indicating a potential turnaround.

Market Analysis

Market experts suggest that the recent developments, including the alignment with the Reserve Bank of India’s new guidelines and the infusion of funds from institutional investors, have positively impacted market sentiment towards Yes Bank. Brokerage firms such as ICICI Direct and Motilal Oswal have issued positive ratings, suggesting a target price range of ₹20-₹22 within the next few months, driven by improved fundamentals and investor confidence.

Challenges Ahead

Despite these positive indicators, Yes Bank still faces challenges such as stiff competition from larger public sector banks and the ongoing need to restore consumer trust. Additionally, any future regulatory changes or economic downturns could affect its market performance. Investors are advised to remain cautious and keep a keen eye on the bank’s quarterly results and broader economic indicators.

Conclusion

In conclusion, Yes Bank’s share price reflects a complex interplay of recovery signs and underlying challenges. For investors, it is crucial to monitor ongoing developments and market conditions closely. The optimism surrounding Yes Bank raises the possibility of further price appreciation in the medium term, but careful consideration should be given to the associated risks. As the financial landscape continues to evolve, staying informed will be key for current and prospective investors.