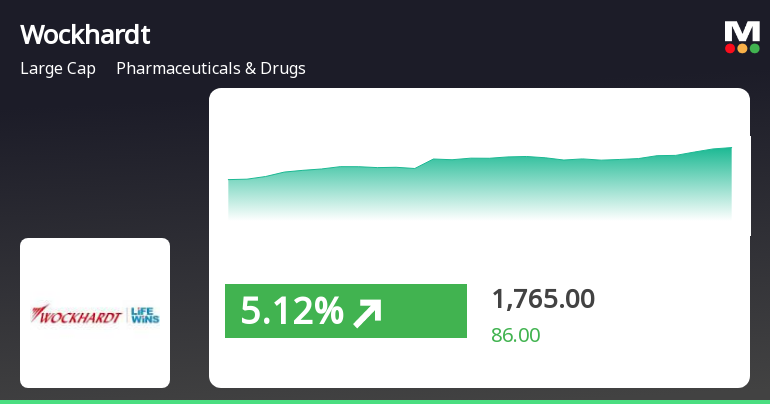

Latest Trends in Wockhardt Share Price

Introduction

Wockhardt Ltd., a leading global pharmaceutical and biotech company based in India, has been the focus of investor attention recently due to its fluctuating share price. Understanding the dynamics of Wockhardt’s share price is essential for investors, stakeholders, and market analysts, as it reflects the company’s performance and market perception.

Current Market Scenario

As of October 2023, the Wockhardt share price has witnessed significant changes influenced by various factors, including quarterly earnings, regulatory approvals, and overall market trends. Recently, the stock was trading at approximately INR 550 per share, showing a considerable increase of over 15% in the last month. This uptrend can be attributed to the company’s successful launch of new products and positive news regarding its vaccine portfolio.

Market Influences

Several key events have impacted Wockhardt’s share price. Firstly, the approval of their latest biosimilars has garnered a positive response from the market, as these products are expected to enhance revenue significantly. Furthermore, strategic partnerships, including collaborations with international pharmaceutical firms, have bolstered investor confidence.

Moreover, analysts have reported that Wockhardt’s commitment to R&D and innovation in healthcare plays a pivotal role in sustaining its market position. The company’s focus on increasing production capacities in response to growing global health demands has also positively influenced investor sentiments.

Future Outlook

Looking ahead, analysts predict that Wockhardt’s share price may continue to rise if the company maintains its growth trajectory and manages to capitalize on emerging market opportunities. The ongoing global emphasis on healthcare, especially post-pandemic, positions Wockhardt favorably to expand its operations and potentially diversify its product offerings.

Conclusion

In conclusion, monitoring the Wockhardt share price is crucial for investors looking to make informed decisions. With the company’s promising developments and innovations, there is a sense of optimism about its financial future. Prospective investors and market participants should stay updated with ongoing trends and financial reports to leverage potential opportunities in Wockhardt’s stock.