Latest Trends in Vodafone Share Price: November 2023

The Importance of Vodafone Share Price

Vodafone Group Plc is a leading telecommunications company that operates in multiple countries and plays a critical role in the global telecom industry. Tracking the share price of Vodafone is essential for investors, analysts, and those interested in the stock market, as it can provide insights into the company’s performance, market perception, and potential future growth.

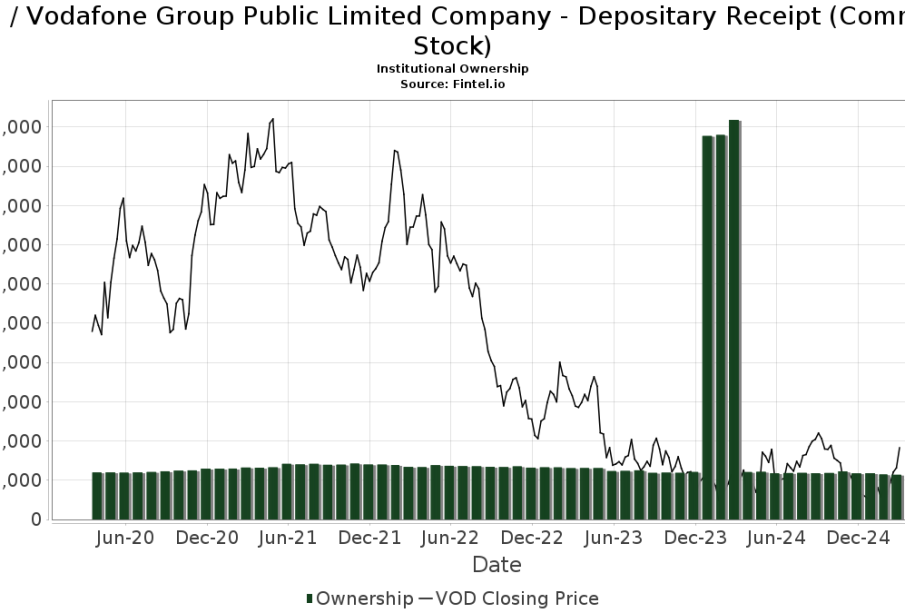

Current Vodafone Share Price Trends

As of November 2023, Vodafone’s share price has shown significant volatility, reflecting broader market trends and company-specific developments. Currently, the share price stands at approximately ₹85 per share on the Bombay Stock Exchange (BSE), which represents a slight increase from earlier this month, when it was around ₹80. This increment comes amid various factors influencing investor sentiment, including the anticipated quarterly earnings report scheduled for late November.

Market analysts attribute the recent rise to positive news regarding Vodafone’s strategic initiatives aimed at reducing its debt burden and improving its operational efficiency. Recently, the company announced a plan to divest several non-core assets, which has been received positively by investors, leading to a gradual uptick in the stock’s performance.

Factors Influencing Share Price

Several key factors are currently impacting Vodafone share price:

- Debt Management: Vodafone has been grappling with significant debt levels, and their ongoing efforts to manage and reduce this debt are critical for restoring investor confidence.

- Market Competition: The competitive landscape in the telecom sector, particularly in markets such as India, greatly influences investor outlook. With intense competition among telecom players, Virgin Media and other challengers continue to put pressure on profit margins.

- Regulatory Environment: Changes in government policies and telecom regulations in countries where Vodafone operates can affect operational costs and market dynamics, thus impacting stock performance.

Investor Takeaways

For potential investors, observing Vodafone share price patterns and underlying factors is crucial. Analysts recommend keeping an eye on the upcoming earnings report, as it could significantly influence share performance. If Vodafone reports better-than-expected results and continues to show progress in debt reduction, the stock may see further upward momentum.

Conclusion

In conclusion, Vodafone share price remains a pivotal indicator of the company’s health and market position. With several strategic initiatives underway and a proactive approach to debt management, Vodafone appears to be on better footing than in previous years. Investors should remain informed and vigilant, as market conditions can change rapidly, and staying updated with financial news is vital for making informed investment decisions.