Latest Trends in the Nikkei 225 Index

Introduction

The Nikkei 225 is Japan’s premier stock market index, representing the top 225 companies listed on the Tokyo Stock Exchange. It is a key indicator of the overall health of Japan’s economy and plays a significant role in global financial markets. As investors keenly watch its movement, understanding the factors influencing the Nikkei 225 has become increasingly crucial, especially amidst a rapidly changing economic landscape.

Current Performance and Trends

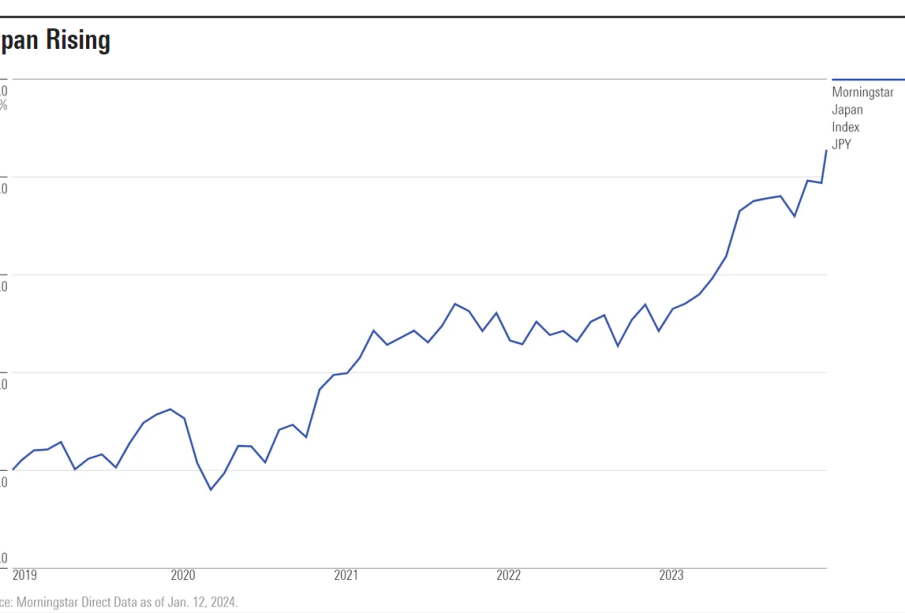

As of October 2023, the Nikkei 225 has shown significant volatility, reflecting mixed sentiments among investors. The index recently closed at approximately 32,000 points, experiencing fluctuations due to a combination of domestic and international factors. While strong earnings reports from major Japanese corporations such as Toyota and Sony contributed to a bullish outlook, concerns over inflation and rising interest rates have tempered investor enthusiasm.

The global economic climate has also played a pivotal role in the index’s performance. As the United States Federal Reserve signals potential rate hikes, Asian markets, including Japan, are on high alert. Economic relations between Japan and China further influence market stability, as any geopolitical tensions can lead to investor caution.

Factors Impacting the Nikkei 225

Several key factors have been impacting the Nikkei 225 recently:

- Corporate Earnings: Positive earnings from Japan’s major companies have provided support to the index, with sectors such as technology and automotive leading the charge.

- Monetary Policy: The Bank of Japan’s ultra-low interest rate policy continues to support the market, but any hints of change could drastically affect the Nikkei 225.

- Global Economic Signals: US economic indicators and international trade relations also hold significant sway over investor sentiment.

Conclusion

In conclusion, the Nikkei 225 stands as a critical measure of Japan’s economic health and investor confidence. With ongoing developments in corporate earnings, monetary policy, and global economic trends, stakeholders will need to remain vigilant. As we move forward, experts predict that the index might continue to experience fluctuations but could stabilize if corporate profitability remains strong and global economic conditions improve. For investors, closely monitoring the Nikkei 225 is essential for making informed decisions in a volatile market environment.