Latest Trends in Tata Steel Share Price

Introduction

Tata Steel, one of India’s largest steel manufacturing companies, plays a pivotal role in the Indian economy. As a listed entity on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), its share price is closely monitored by investors and analysts. Understanding the share price dynamics of Tata Steel is crucial for stakeholders looking to navigate the volatile stock market.

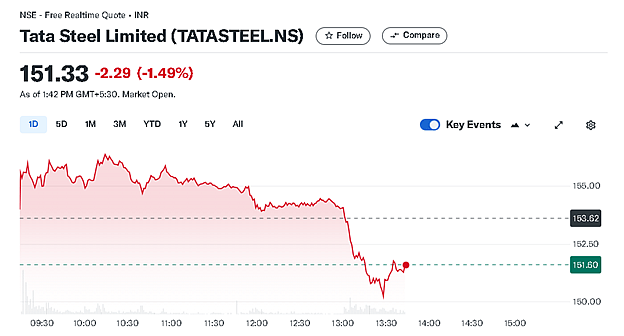

Current Market Situation

As of mid-October 2023, Tata Steel’s share price has shown remarkable resilience despite fluctuations in the global steel market. The stock recently traded at approximately ₹110 per share, reflecting a steady increase of about 5% over the past month, supported by strong quarterly earnings that exceeded market expectations. Analysts attribute this uptick to improved demand in both domestic and international markets, particularly driven by infrastructure projects and construction activities.

Factors Influencing Share Price

The Tata Steel share price is influenced by various factors, including global steel prices, raw material costs, and overall economic conditions. Recent government initiatives supporting infrastructure development have resulted in increased steel consumption, positively impacting Tata Steel’s production capacity and pricing strategies. Furthermore, the ongoing recovery post-COVID-19 pandemic in key sectors such as automotive and construction has provided a significant boost to Tata Steel’s business performance.

Analyst Recommendations

Analysts remain optimistic about Tata Steel’s future with several brokerage firms maintaining a ‘buy’ rating on the stock. According to reports from market analysts, the company’s sustainable practices and focus on reducing carbon emissions could further enhance its market value. With steel prices expected to stabilize globally, Tata Steel is anticipated to witness continuing demand growth, making it a potential long-term investment.

Conclusion

In summary, Tata Steel’s share price remains a focal point for investors, reflecting the broader trends within the economy. With a solid business foundation and positive market conditions, Tata Steel is well-positioned for growth in the coming quarters. Investors should keep a close watch on global market developments and government policies that could affect the steel industry, as these will inevitably impact Tata Steel’s share price in the future.