Latest Trends in Reliance Share Performance

Importance of Reliance Shares

Reliance Industries Limited, one of India’s largest conglomerates, plays a significant role in the Indian stock market. Its shares have always been viewed as a barometer for the economic health of the country due to its diversified business operations ranging from petrochemicals and refining to telecommunications and retail.

Current Market Trends

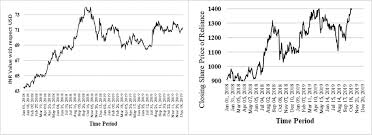

As of October 2023, Reliance shares have seen notable fluctuations amid market volatility. The opening price of Reliance shares was recorded at INR 2,600, but following a series of announced expansions in their digital services and a strong quarterly profit report, shares rose to INR 2,720, representing a growth of approximately 4.6% in the past month.

Moreover, analysts suggest that Reliance’s continued focus on renewable energy projects is contributing positively to investor sentiment. With the global push towards sustainable energy, Reliance’s investments in solar energy and green hydrogen are viewed favorably. The company’s strategic move to reduce its carbon footprint has been highlighted in recent financial conferences.

Future Projections

Looking ahead, industry experts have mixed views on the trajectory of Reliance shares. Some anticipate that the shares will stabilize around the INR 2,700 mark, while others predict a potential further rally if the company successfully leverages its strengths in technology and retail. According to a recent report from Motilal Oswal, if Reliance management continues to execute its strategic vision effectively, its market capitalisation could exceed INR 20 lakh crores within the next two to three years.

Conclusion

In summary, Reliance shares are currently experiencing a positive upward trend, driven by strategic business expansions and favorable market factors. Investors are encouraged to keep a close eye on the company’s developments in renewable energy, as well as its quarterly performance reports, which are likely to affect share price movements significantly. For potential investors, these dynamics present both opportunities and challenges, underscoring the importance of careful analysis before making investment decisions.