Latest Trends in NMDC Share Price: Key Insights

Introduction

The share price of National Mineral Development Corporation (NMDC) serves as a crucial indicator for investors in the mining sector. Recent fluctuations in NMDC’s stock have captivated both institutional and retail investors, particularly as iron ore prices and global demand have seen significant variances. Understanding NMDC’s share price trends is essential for making informed investment decisions.

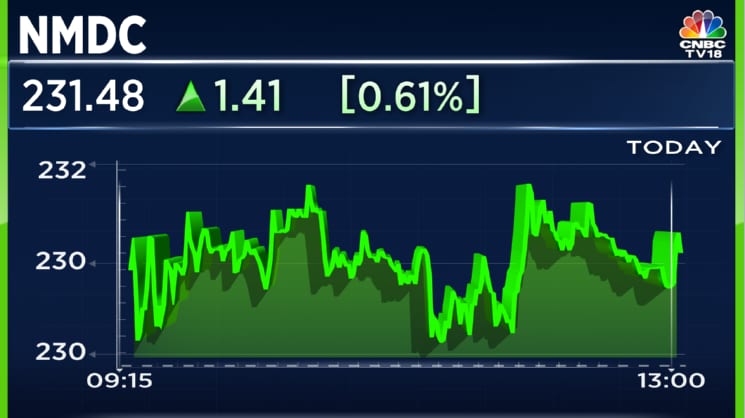

Current Share Price Overview

As of October 2023, NMDC’s shares are trading at approximately ₹120, experiencing a slight increase of 1.5% over the past week. The stock reached a 52-week high of ₹135 in late September, fueled by positive quarterly earnings reports and a robust demand forecast for iron ore. Analysts suggest that ongoing infrastructure projects by the Indian government will continue supporting the demand for NMDC’s products.

Market Influences

Several factors currently influence NMDC’s share price. Firstly, the fluctuations in global iron ore prices play a significant role. Recent reports indicate that iron ore prices have stabilized due to supply adjustments from major producers like Australia and Brazil. This stabilization has bolstered investor confidence in NMDC.

Secondly, the Indian government’s push for infrastructure development is set to increase the demand for steel, thereby enhancing iron ore production and sales. With sectors like construction and railways receiving a substantial budget allocation, NMDC stands to benefit from increased orders in the coming months.

Expert Analysis

Investment analysts maintain a ‘buy’ recommendation on NMDC shares, citing strong fundamentals and attractive pricing strategy. The company’s efforts in expanding mining operations and its commitment to sustainability are seen as proactive steps towards maintaining market competitiveness. Furthermore, the recent divestment in a new iron ore mine is expected to boost production capacity significantly.

Conclusion

In summary, NMDC’s share price presents a compelling case for investors, underpinned by favorable market conditions and proactive management strategies. As the mining sector evolves, staying updated on such trends will be crucial for making well-informed investment decisions. Analysts are optimistic about NMDC’s potential, predicting that shares could rally as market conditions continue to improve. Investors should monitor the evolving dynamics in iron ore pricing and government policy changes, which could further impact NMDC’s share performance in the near future.