Latest Trends in Nestle India Share Price

Introduction

Nestle India has consistently been a significant player in the FMCG sector in India. Its products, ranging from instant noodles to dairy products, hold a special place in Indian households. As a publicly traded company, the share price of Nestle India becomes a critical indicator of its financial health and market perception. Investors and stakeholders closely monitor fluctuations in share prices to make informed decisions. The recent trends in the share price of Nestle India not only impact investors but also reflect broader market sentiments and economic conditions.

Current Share Price Context

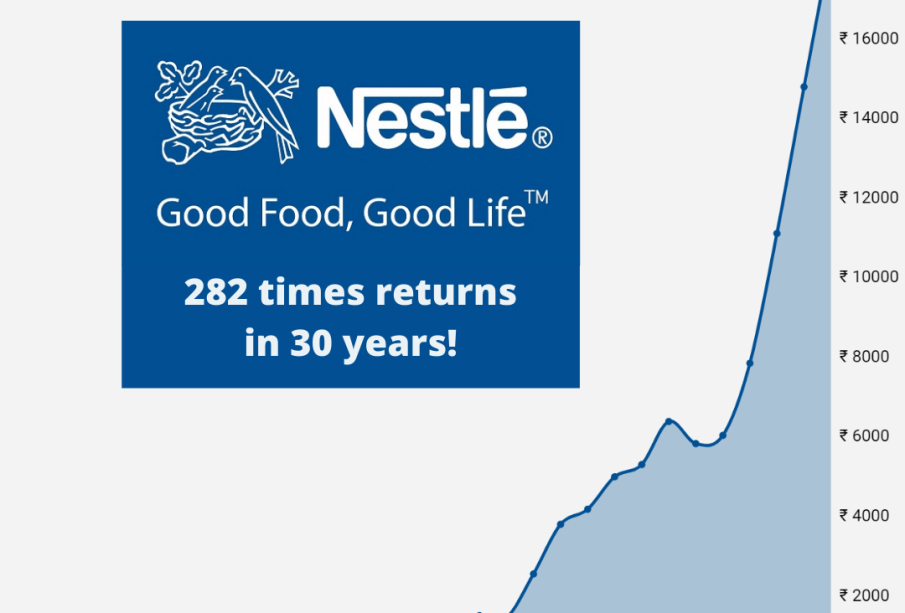

As of October 2023, Nestle India’s share price has shown considerable volatility, typical of the FMCG sector. The share price was recorded at approximately INR 20,000, marking a slight increase from the beginning of the year. Analysts attribute this rise to several factors, including robust earnings reports and strong demand for Nestle’s products even in challenging economic conditions. Furthermore, Nestle India reported a revenue growth of 14% in the last quarter, significantly influencing investor confidence.

Market Performance and Analysis

Several market experts have released analyses predicting a continued positive outlook for Nestle India shares. According to research published by a leading financial institution, the company’s strong brand equity and expansion plans in India are likely to sustain growth in its share price. Additionally, factors such as increased online sales, diversification of product lines, and investments in health and wellness are expected to boost performance moving forward. With global supply chain challenges easing, analysts suggest Nestle India might also benefit from reduced operational costs in the coming months.

Comparative Analysis

When compared to its peers in the FMCG sector, Nestle India continues to perform well. Companies like Hindustan Unilever and Dabur India have shown similar trends in share price, driven by their respective market strategies. However, Nestle India’s focus on premium products has provided it with a competitive edge, evident in its market share gains in certain categories. Investors are particularly watching how these companies adapt to changing consumer preferences and economic conditions, considering factors like rising inflation and shifts in consumer spending.

Conclusion

The share price of Nestle India remains a key indicator of its ongoing success and challenges in a competitive market. As the company continues to innovate and adapt in response to market demands, investors are advised to stay informed about potential shifts in share price due to both internal performance metrics and external economic factors. With current predictions indicating a stable trajectory for Nestle India, it remains a compelling option for investors looking at long-term growth in the FMCG space.