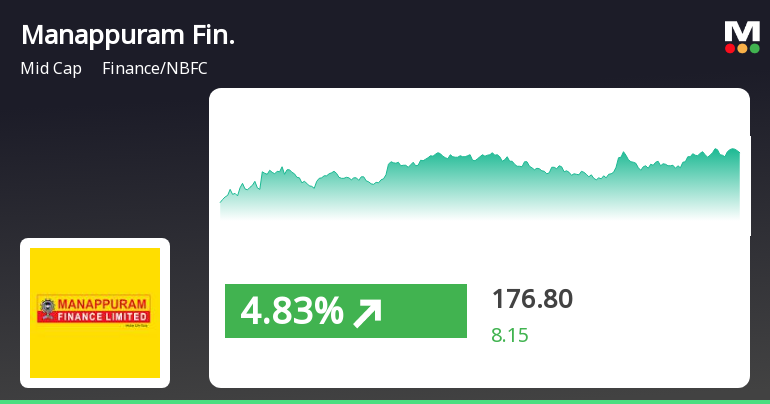

Latest Trends in Manappuram Share Price

Importance of Manappuram Share Price

The share price of Manappuram Finance Limited is a significant indicator for investors looking to navigate the dynamic landscape of the Indian financial market. As a leading player in the gold loan sector, fluctuations in its stock reflect broader trends in consumer confidence and economic health.

Current Market Trends

As of October 2023, Manappuram share price has experienced notable volatility amid changing economic signals. The stock opened at ₹125 earlier this month before surging to a peak of ₹130 due to positive quarterly earnings reports that showed a growth in loan disbursements and a steady recovery in demand for gold loans, driven by the festive season in India.

Market analysts attribute recent upward movements in Manappuram’s stock to overall bullish sentiment in the financial sector, particularly for companies that focus on gold loans, which have become a popular option among consumers amidst rising gold prices.

Factors Influencing the Share Price

Several factors can impact the share price of Manappuram. These include:

- Regulatory Changes: Adjustments in policy relating to non-banking financial companies (NBFCs) can influence operational costs and profitability.

- Gold Prices: As a gold loan provider, fluctuations in gold prices directly affect the company’s asset base and borrowing capacity.

- Market Sentiment: General market trends and investor sentiment towards the finance sector can also play a crucial role.

Conclusion and Future Outlook

Looking ahead, financial analysts remain cautiously optimistic about Manappuram’s share price trajectory. With the upcoming festive season anticipated to boost gold jewelry purchases, Manappuram could see further growth. However, potential investors must remain vigilant to external economic factors that can introduce volatility.

In summary, the Manappuram share price is not just a reflection of the company’s current operations, but also an indicator of broader market trends and consumer behavior in India. Keeping a close eye on this stock can provide valuable insights for both seasoned investors and newcomers alike.