Latest Trends in JP Associates Share Price

Introduction

JP Associates, also known as Jaiprakash Associates Limited, is one of India’s prominent players in the construction and real estate sectors. Understanding the fluctuations in its share price is not only crucial for investors but also indicative of the overall market sentiment regarding infrastructure development in India. With increased government focus on infrastructure projects in recent years, tracking the share price of JP Associates offers valuable insights into the company’s performance and prospects.

Current Market Performance

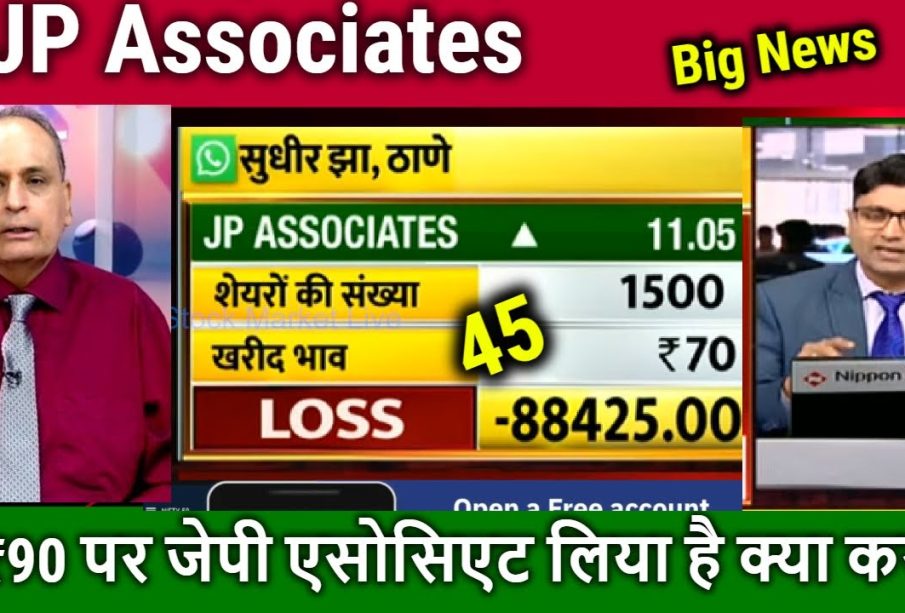

As of late October 2023, the share price of JP Associates has shown notable volatility. Recently, it has traded in the range of INR 10 to INR 12 per share, reflecting both investor optimism and concerns regarding operational efficiency. Factors influencing the share price include recent announcements of new project acquisitions, updates on debt restructuring plans, and broader economic indicators such as GST collection trends.

Key Developments

One significant factor affecting JP Associates’ share price is the company’s strategic entry into renewable energy projects, which aligns with India’s push towards sustainable energy solutions. Furthermore, improvements in the company’s financials after debt reduction and successful divestments have generated positive sentiment among investors. In its latest quarterly report, JP Associates reported a revenue growth of 15%, which has been well-received by the market.

Investor Sentiment and Outlook

Analysts remain cautiously optimistic about the future of JP Associates. While current performance metrics are promising, external factors such as fluctuating raw material prices and regulatory changes could pose risks. The company is expected to continue benefiting from infrastructure spending by the Indian government, particularly in roads, highways, and urban development projects.

Conclusion

In conclusion, JP Associates’ share price movements reflect broader trends in India’s infrastructure sector. While recent developments indicate a positive trajectory, potential investors should remain aware of the inherent risks associated with market volatility. Forecasts suggest that if the company can maintain its operational momentum and adapt to changing market conditions, the share price may see favorable growth in the coming months. Investors are advised to stay informed and consider both short-term and long-term factors when assessing their investment decisions in JP Associates.