Latest Trends in IREDA Share Price

Importance of IREDA Share Price

The Indian Renewable Energy Development Agency (IREDA) plays a crucial role in financing renewable energy projects in India. As the world shifts towards sustainable energy, tracking IREDA’s share price is essential for investors looking for opportunities in the green energy sector. The fluctuations in IREDA share price can indicate broader trends in the renewable energy market and reflect investor confidence.

Recent Developments

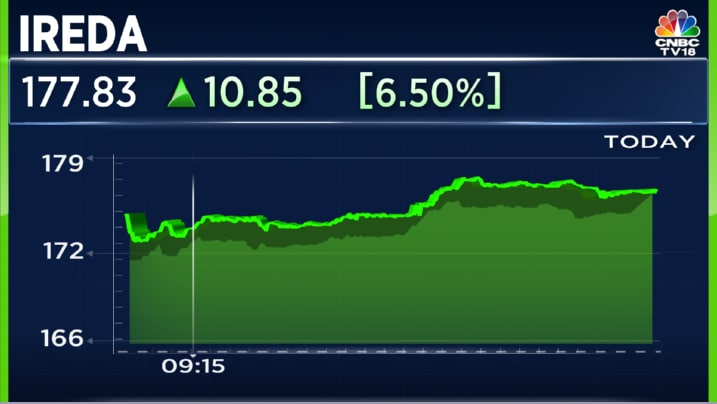

As of late October 2023, IREDA’s share price has shown significant volatility due to market reactions to government policies promoting renewable energy. Recently, the Indian government announced an increased budget allocation for renewable energy projects, causing a positive response from shareholders. The share price reached a peak of ₹160 before experiencing a slight correction, stabilizing around ₹150 per share.

Analysts attribute this rise to several factors, including favorable government incentives, increasing focus on sustainable solutions, and global trends towards reducing carbon footprints. Additionally, IREDA has reported a steady growth in its loan disbursement for renewable projects, indicating robust demand and confidence among developers.

Analyst Insights and Future Outlook

Market analysts suggest that IREDA’s share price could continue to rise in the upcoming quarters due to an expected surge in investments in the solar and wind sectors. The increasing need for clean energy, driven by both domestic and global agendas, positions IREDA strategically to capitalize on growing market needs. Investment in IREDA shares is recommended for long-term investors looking to benefit from the green energy revolution.

However, potential investors should remain cautious of market corrections and monitor governmental policies closely, as changes can rapidly influence share prices. Keeping an eye on macroeconomic factors and investor sentiment will be crucial in navigating this dynamic market.

Conclusion

IREDA’s share price serves not only as a financial indicator for the agency but also as a bellwether for the overall health of the renewable energy sector in India. With significant government backing and an industry-wide shift towards sustainability, IREDA is positioned for potential growth. Investors eyeing green energy opportunities should consider tracking IREDA’s share price as part of their investment strategy.