Latest Trends in Intel Share Price: Insights and Forecasts

Introduction

The share price of Intel, one of the leading semiconductor manufacturers, has significant relevance in both the technology sector and the global stock market. Understanding fluctuations in Intel’s share price is crucial for investors, analysts, and tech enthusiasts alike, especially as it reflects broader trends in the industry.

Current Share Price Performance

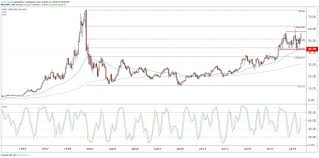

As of October 2023, Intel’s share price has been experiencing considerable volatility, driven by multiple factors including market competition, ongoing supply chain challenges, and the company’s strategic realignment. Recently, Intel shares were trading at approximately $31, marking an increase of nearly 8% over the month, reflecting a slight recovery from a prolonged period of decline.

Factors Influencing Intel’s Share Price

A key factor influencing Intel’s share price is the competitive landscape in the semiconductor industry. Rivals such as AMD and NVIDIA have introduced advanced technologies that challenge Intel’s market dominance. Moreover, supply chain disruptions from global events continue to impact production rates, further affecting the company’s profitability. Additionally, Intel’s recent efforts to pivot its focus towards AI and data center business have garnered optimistic projections from analysts, contributing to the recent uptick in share values.

Recent Developments and Market Response

In early October 2023, Intel announced its quarterly earnings, reporting stronger-than-expected revenue driven by a rebound in demand for its data center products. This announcement was well-received by the market, resulting in a spike in the stock price post-earnings call. Furthermore, analysts highlight Intel’s ambitious plans to reclaim market share with investments in advanced manufacturing processes, which could yield long-term benefits and further stabilize its share price.

Conclusion

The current trends in Intel’s share price suggest a cautious optimism amongst investors as the company navigates challenges and seizes emerging opportunities in technology. As Intel continues to innovate and adapt to market demands, its share price may exhibit resilience, offering potential growth for stakeholders. Industry watchers anticipate that the next earnings report and strategic announcements regarding production advancements will play a critical role in shaping investor sentiment moving forward. For those tracking technology investments, Intel remains a critical stock to watch amidst these transformative times.