Latest Trends in IDFC Bank Share Price

Introduction

The share price of IDFC Bank has garnered considerable attention in recent months as it reflects the bank’s overall performance and investor sentiment. Understanding the factors influencing these fluctuations is crucial for investors and stakeholders who are keen on the banking sector’s growth and stability.

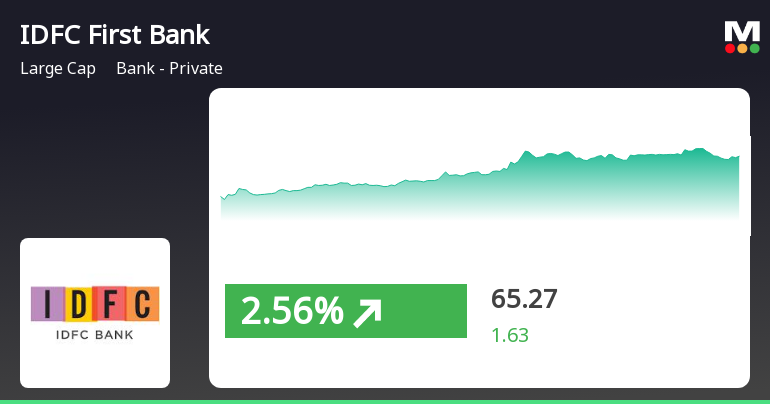

Current Share Price Overview

As of late October 2023, IDFC Bank’s share price is trading at approximately ₹90 per share, experiencing an increase of nearly 10% over the past month. Analysts are optimistic about the bank’s financial health, given its improving net interest margins and robust loan growth. The positive momentum is attributed to several strategic initiatives undertaken by the bank, including enhancing its digital banking services and expanding its customer base.

Factors Influencing IDFC Bank’s Share Price

Several key factors are driving the performance of IDFC Bank’s shares:

- Strong Financial Results: The bank reported a 20% year-on-year growth in its net profit in the last quarter, which significantly boosted investor confidence.

- Market Conditions: The Indian banking sector is witnessing a revival post-pandemic, with increasing loan demands and better asset quality, reflecting positively on bank valuations.

- Regulatory Developments: Recent RBI policies favoring liquidity support have contributed to favorable banking conditions, benefitting institutions like IDFC Bank.

Future Outlook

Considering the current trajectory, analysts predict that IDFC Bank’s share price might continue to rise, potentially reaching ₹100 by the end of 2023, given the bank’s solid operational strategy and economic recovery in India. However, investors are advised to monitor prevailing market conditions, including interest rates and regulatory changes, which could impact share performance.

Conclusion

In summary, the IDFC Bank share price is reflective of its ongoing growth strategies and the overall improvement in the banking sector. Enthusiastic investor sentiment, coupled with positive financial outcomes, suggests a favorable outlook for prospective and current shareholders. Keeping abreast of the market conditions and the bank’s financial health will be essential for making informed investment decisions.