Latest Trends in HBL Engineering Share Price

Importance of Tracking HBL Engineering Share Price

The stock market plays a crucial role in the economic landscape, and following share prices of companies like HBL Engineering can significantly influence investors’ decision-making. As a prominent player in the engineering sector, HBL Engineering operates in areas such as defense electronics and industrial automation. Understanding the factors behind the fluctuations in HBL Engineering’s share price is essential for investors looking to capitalize on market trends.

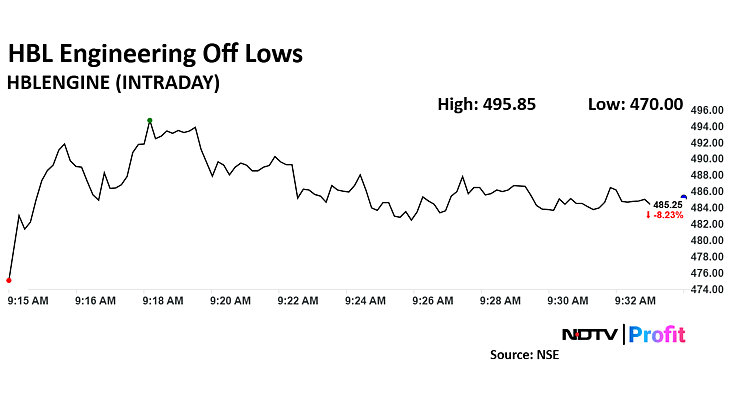

Current Share Price Overview

As of the latest trading session on October 15, 2023, HBL Engineering’s share price stands at ₹1,200.00, reflecting a steady increase of approximately 2.5% over the past week. The share has seen a notable rise since the beginning of the month, driven by positive market sentiment and strong quarterly earnings reports. The company’s recent financial disclosures revealed a revenue growth of 15% year-on-year, which has bolstered investor confidence.

Factors Influencing Share Price Movement

Several key factors impact the share price of HBL Engineering:

- Market Trends: The overall performance of the stock market significantly affects HBL Engineering. A bullish market typically results in increased share prices, while bearish conditions can lead to declines.

- Company Performance: Strong financial results, new contracts, and expansion projects contribute positively to the share price. HBL’s recent acquisition of a leading technology firm is expected to expand its product line and market reach.

- Industry Developments: Being in the engineering and electronics sector, advancements in technology and defense policies can play a significant role in shaping share prices.

- Investor Sentiment: Changes in investor sentiment, driven by news events, analyst ratings, or global economic conditions, can lead to rapid changes in share prices.

Future Outlook for HBL Engineering

Looking ahead, analysts forecast a positive trajectory for HBL Engineering’s share price, projecting it could reach as high as ₹1,300 by the end of the current quarter. Factors including increased government spending on defense infrastructure and the company’s ongoing efforts in technological innovation are expected to drive growth. However, investors are advised to closely monitor market conditions and watch for any changes in company performance that may impact future evaluations.

Conclusion

In summary, the HBL Engineering share price remains an important indicator for those interested in the engineering and technology sectors. Staying informed on the latest trends, company developments, and market dynamics is crucial for investors. With a promising outlook, HBL Engineering is positioned to capture growth opportunities, making it a noteworthy option for potential investors.