Latest Trends in Cipla Share Price

Introduction to Cipla and Its Market Relevance

Cipla Limited is one of India’s leading pharmaceutical companies, renowned for its extensive range of medicines and healthcare solutions. As a key player in the healthcare sector, the stock performance of Cipla directly impacts investor sentiment and the overall market trends in pharmaceuticals. Understanding the trends in Cipla’s share price is crucial for investors, analysts, and industry stakeholders, especially given the increasing focus on healthcare post-pandemic.

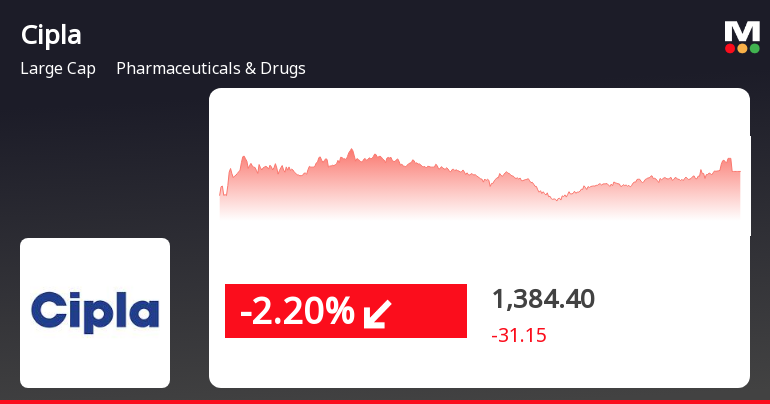

Current Market Performance

As of the latest available data in October 2023, Cipla’s share price has shown significant fluctuations, driven by various factors including quarterly earnings, regulatory approvals, and global market dynamics. The stock was trading around ₹1,065 per share, reflecting a consistent growth trajectory over the past year. Cipla’s performance can be attributed to its strong sales in both domestic and export markets, as well as its ongoing commitment to research and development which keeps it competitive in the global pharmaceutical landscape.

Factors Influencing Cipla Share Price

Recent developments have had a considerable impact on Cipla’s share price. Notably, the company’s announcement of partnerships for groundbreaking research in oncology and respiratory disorders has generated positive investor outlooks. Furthermore, analysts have pointed to the successful launch of new generic drugs in the U.S. market as a catalyst for future growth. Additionally, fluctuations in raw material costs and regulatory changes in India and abroad are crucial elements that can affect share performance in the near future.

Future Outlook

Looking ahead, market analysts foresee a positive outlook for Cipla’s share price, with forecasts indicating potential growth opportunities amidst rising healthcare demand and expansion plans. The company’s robust pipeline and strategic collaborations are likely to strengthen its market position further. However, investors should remain vigilant about global economic conditions and regulatory environments that could impact its operations.

Conclusion

In conclusion, tracking the Cipla share price is essential for making informed investment decisions. As Cipla continues to innovate and expand, its share price will likely reflect its operational success and market confidence. Investors are encouraged to stay updated with market trends and company announcements that could influence share valuations. The pharmaceuticals sector remains a key area of interest, with Cipla at the forefront of potential growth.