Latest Trends in Apollo Micro Systems Shares

Introduction

Apollo Micro Systems Ltd., a prominent player in the defence and aerospace sectors, has been making waves in the stock market. With an increasing focus on indigenous technology and manufacturing, the company’s shares have shown significant movement in recent times. The relevance of tracking Apollo Micro Systems’ share performance is essential for investors looking to capitalize on the burgeoning Indian defence industry.

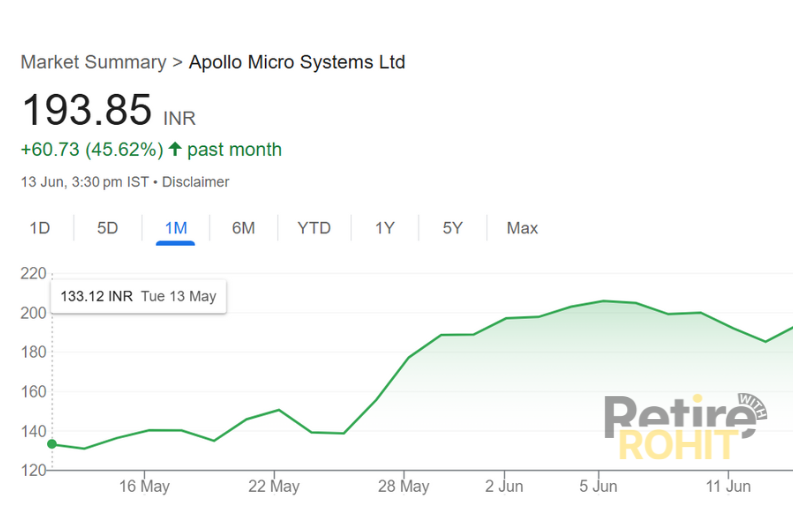

Recent Performance

As of October 2023, Apollo Micro Systems’ shares have seen fluctuations typical of the high-tech industry. Recently, the share price saw a peak of ₹800, which was prompted by a surge in government contracts aimed at bolstering national security. Analysts highlight that the company’s robust order book, which exceeds ₹1,000 crore, has positively impacted market sentiment around its shares.

Strategic Developments

The company has recently announced partnerships with leading defence contractors for the co-development of advanced systems. This move is projected to enhance their product offerings while ensuring a steady revenue stream. Furthermore, the Indian government’s push for self-reliance in defence manufacturing under the ‘Atmanirbhar Bharat’ initiative is expected to benefit companies like Apollo Micro Systems significantly.

Market Sentiments

Market analysts predict a positive trajectory for Apollo Micro Systems shares, driven by increasing defence budgets and the company’s proactive approach to securing contracts. Institutional investors are slowly taking positions, instilling confidence in retail investors. However, competition and technological advancements remain key factors that investors will need to monitor closely.

Conclusion

The significance of monitoring Apollo Micro Systems shares extends beyond immediate financial gains. As India’s defence manufacturing sector evolves, businesses like Apollo Micro Systems play a crucial role in driving innovation and economic growth. Investors may find it beneficial to engage with these trends, fostering informed decisions in an ever-changing market landscape.