Latest Trends in Apollo Micro Systems Share Price

Introduction

Apollo Micro Systems, a leading player in the aerospace and defense sector in India, has garnered significant interest from investors over the past year. The company’s share price is a critical indicator of its financial health and market positioning, making it vital for stakeholders to understand the current trends and future projections.

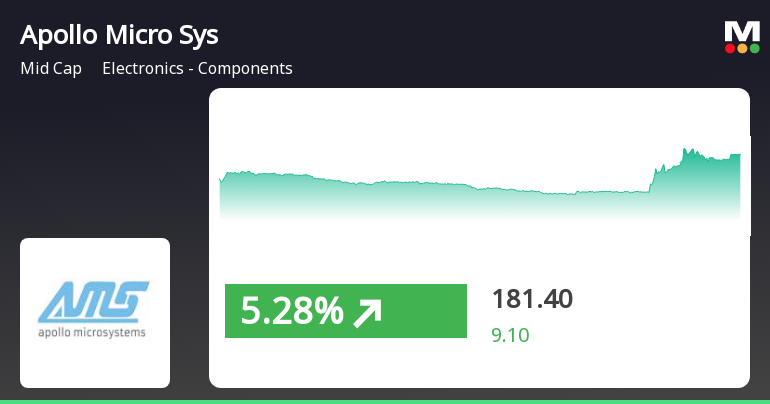

Current Share Price Trends

As of October 2023, Apollo Micro Systems’ share price reflects a robust performance in response to various developments within the company and the broader market. The shares have shown resilience, trading around INR 400, which represents a notable increase from the previous quarter. The increase can be attributed to a series of successful contract wins in defense projects, aligning with India’s ongoing efforts to enhance its defense capabilities.

Recent Developments

Recently, Apollo Micro Systems announced a significant contract to provide advanced electronic systems for the Indian armed forces, which has been a key driver for their share price increase. The company’s focus on expanding its portfolio to include newer technologies in unmanned systems and robotics also generated positive investor sentiment. Following these announcements, analysts have reiterated ‘Buy’ ratings on the company’s stock, citing strong fundamentals and growth potential.

Market Sentiment and Future Outlook

The overall market sentiment towards Apollo Micro Systems remains optimistic, bolstered by the government’s push for self-reliance in defense manufacturing. Investment analysts predict that the share price may continue to rise, particularly if the company can secure additional contracts and enhance its operational efficiency. It is important for investors to remain vigilant and consider external factors such as global defense spending trends and macroeconomic conditions that might affect future performance.

Conclusion

In conclusion, the Apollo Micro Systems share price is currently reflecting strong market confidence and growth potential driven by contract wins and expansion into new technology areas. For investors, staying updated on the company’s performance and market trends will be essential in navigating potential risks and opportunities in the volatile stock market. As defense budgets globally are projected to rise, Apollo Micro Systems appears well-positioned for continued success in the coming years.