Latest Trends in Adani Enterprises Share Price

Introduction

The share price of Adani Enterprises has been a key focus for investors and market analysts alike, especially given the company’s significant role in various sectors such as energy, resources, and infrastructure. As one of India’s largest conglomerates, Adani Enterprises’ stock performance not only impacts its stakeholders but also reflects wider economic trends and investor sentiment in the Indian market.

Current Performance of Adani Enterprises Share Price

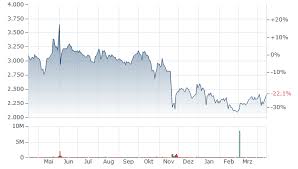

As of recent market close, the share price of Adani Enterprises stands at INR 1,700, having experienced a fluctuation of 2% over the past week. Notably, the company’s shares have shown resilience in the face of market volatility, largely attributed to strong quarterly earnings reports and strategic initiatives outlined by the management.

Factors Influencing Price Movements

Several factors influence the price of Adani Enterprises’ shares, including:

- Market Sentiment: Investor sentiment, particularly following earnings announcements and economic indicators, plays a crucial role in driving price fluctuations.

- Regulatory Developments: Changes in government policies, especially regarding environmental regulations, can significantly impact operations and stock prices.

- Global Economic Conditions: Being involved in various sectors, Adani’s performance is closely tied to global economic health, particularly in commodities and infrastructure.

Recent Developments

In the last month, Adani Enterprises has made headlines for its plans to expand its renewable energy portfolio. Following the announcement of a major investment in solar projects in Gujarat, analysts speculate that this could enhance the company’s growth trajectory, further stabilizing the share price in the long term. Furthermore, positive revenue forecasts have led to increased institutional buying, which has pumped liquidity into the stock.

Conclusion

For investors tracking Adani Enterprises share price, the recent trends indicate both opportunities and challenges. With growing initiatives towards sustainable energy and solid quarterly performances, the company seems poised for growth. However, potential risks associated with regulation and market fluctuations should be closely monitored. Overall, understanding these dynamics will be essential for stakeholders looking to navigate their investments in Adani Enterprises.