Latest Trends and Insights on Infosys Share Performance

Introduction

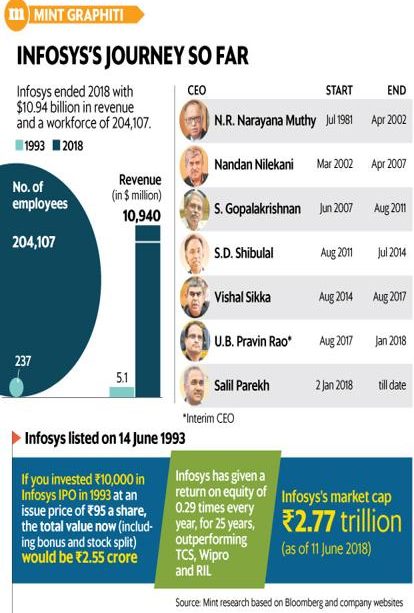

Infosys, a leading IT services company in India, has garnered considerable attention from investors and analysts alike due to its consistent performance in the stock market. With ongoing digital transformation across industries, understanding the trends behind Infosys shares is crucial for both existing and potential investors. This article provides an insightful overview of recent developments and market performance related to Infosys shares.

Recent Performance

As of October 2023, Infosys shares have shown a positive trend, trading at approximately ₹1,500 per share, marking a growth of about 8% over the past three months. This rise can be attributed to the company’s robust earnings report for Q2 FY 2023-24, where Infosys reported a 12% increase in revenue year-on-year to ₹37,300 crores. Additionally, the company’s operating profit margin improved to 23.5%, reflecting operational efficiencies.

Factors Influencing Share Price

Several factors have been influencing the stock price of Infosys:

- Technological Investments: Infosys has made substantial investments in AI and automation, positioning itself as a key player in the digital transformation space.

- Client Acquisition: The company recently secured large contracts with numerous Fortune 500 companies, showcasing a growing client base and solidifying its revenue stream.

- Industry Trends: The global IT services market is projected to grow significantly, further benefiting major players like Infosys.

Market Sentiment and Analyst Ratings

Market sentiment surrounding Infosys remains bullish, with numerous analysts rating the stock as ‘Buy’. According to a Reuters poll, approximately 75% of analysts have a positive outlook on Infosys shares, anticipating further growth in the subsequent quarters. The overall market for IT services is expected to expand, aligning with Infosys’ strategy to target high-growth sectors such as cloud computing and cybersecurity.

Conclusion

In conclusion, Infosys shares have demonstrated robust growth due to favorable market conditions and the company’s strategic initiatives in technology and client engagement. For investors, maintaining an awareness of broader market trends and Infosys’ performance metrics will be essential in making informed decisions. If the current trajectory continues, Infosys is likely to remain a strong contender within the IT services market, promising healthy returns for its shareholders.