Latest Insights on Waaree Energies Share Performance

Introduction

Waaree Energies has emerged as a significant player in the renewable energy sector in India, particularly in solar energy. With increasing global and national focus on sustainable energy solutions, the company’s share performance has become a matter of great interest for investors and market analysts alike. The following report highlights the recent developments and trends affecting Waaree Energies shares, providing insights for current and prospective investors.

Current Market Performance

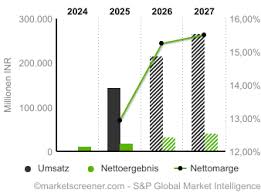

As of October 2023, Waaree Energies shares have shown promising trends, reflecting a bullish sentiment in the market. The company’s recent financial results, disclosed in their quarterly earnings report, indicate a substantial increase in revenue, attributed to a growing demand for solar panels and related technologies. Analysts note that the share price has seen an increase of about 15% in the last quarter alone, indicating positive investor confidence.

Recent Developments

Significantly, Waaree Energies announced a major new project to set up a large-scale solar power plant in Rajasthan, projected to generate 1 GW of renewable energy. This project is expected to not only bolster the company’s revenue but also enhance its position in the market. Furthermore, Waaree has secured contracts for exporting solar technology, which is likely to open new revenue streams and further stabilize share prices.

Market Sentiment and Future Outlook

The sentiment surrounding Waaree Energies shares remains optimistic. Market analysts expect that the growing push for clean energy solutions, supported by government policies and incentives, will continue to drive the company’s growth. Given the overall trend towards sustainability, Waaree’s strategic positioning in the solar energy sector makes it a potentially lucrative investment. However, analysts also advise caution due to the volatile nature of the stock market and suggest that investors keep an eye on both local and global economic conditions that may impact share performance.

Conclusion

In conclusion, Waaree Energies shares are poised for growth amid the rising demand for renewable energy solutions. With robust financial performance and strategic expansion plans, the company’s outlook appears favorable. Investors are encouraged to stay informed on both the company’s ongoing projects and market trends as they consider investment decisions. The renewable energy sector is set to play a vital role in India’s economic future, and Waaree Energies is at the forefront of this transformative change.