Latest Insights on Tanla Share Price

Introduction

The share price of Tanla Solutions, one of India’s leading CPaaS (Communications Platform as a Service) providers, has garnered significant attention in the financial markets recently. Understanding Tanla’s stock movements is essential for investors, analysts, and stakeholders looking to navigate the complexities of the Indian equity market. As digital communication continues to grow in importance, tracking the performance of companies like Tanla becomes crucial.

Current Performance and Trends

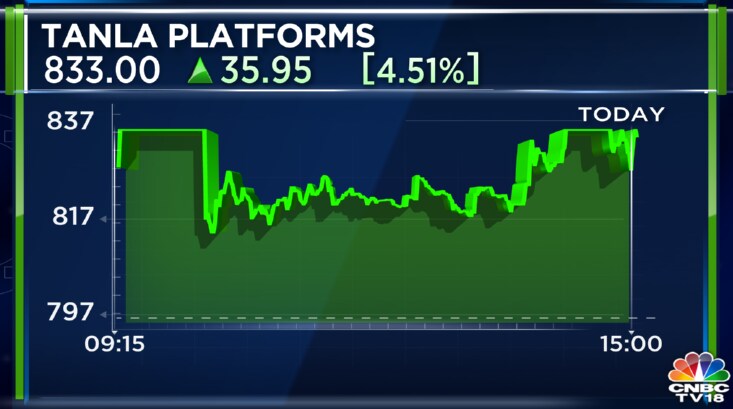

As of the latest trading session, Tanla Solutions’ share price has witnessed fluctuations, reflecting broader market trends and company-specific developments. The stock has, over the past month, experienced a notable increase, climbing approximately 15% from ₹800 to around ₹920, as investors remain optimistic about the company’s growth potential in the digital communication sector.

Analysts attribute this rise to recent announcements regarding partnerships with major corporations and an uptick in demand for its services amidst rising digitalization in both corporate and consumer segments. Furthermore, the company’s recent quarterly earnings report, which indicated a significant year-on-year growth in revenue by 25%, reinforced investor confidence.

Factors Influencing Share Price

Several factors are at play affecting Tanla’s share price, including:

- Market Sentiment: The overall sentiment in the Indian stock market influences Tanla’s stock, with investor reactions to economic indicators and policy changes shaping trading behaviors.

- Company Performance: Quarterly earnings, profit margins, and strategic initiatives announced by Tanla are closely scrutinized by investors.

- Industry Dynamics: With increasing competition in the digital communication arena, any news regarding advancements or regulatory changes within the CPaaS industry can impact Tanla’s share price.

Conclusion

In summary, Tanla Solutions continues to be an important player in the Indian technology space, and its share price movements are indicative of investor confidence in its growth trajectory. Given the rapid advancements in digital communication technologies, the company is poised for further growth. Investors are advised to keep a close watch on both market trends and company announcements as they navigate potential investments in Tanla’s stock. The outlook seems positive, but, as always, due diligence remains essential for making informed investment decisions.