Latest Insights on Tanla Share Price

Introduction

The Tanla Platforms Limited, a leading provider of cloud communication services, has been making headlines in the Indian stock market with its fluctuating share price. As businesses worldwide increasingly rely on cloud communications, the relevance of Tanla as a market player has surged, prompting investors to keep a close watch on its share price movements.

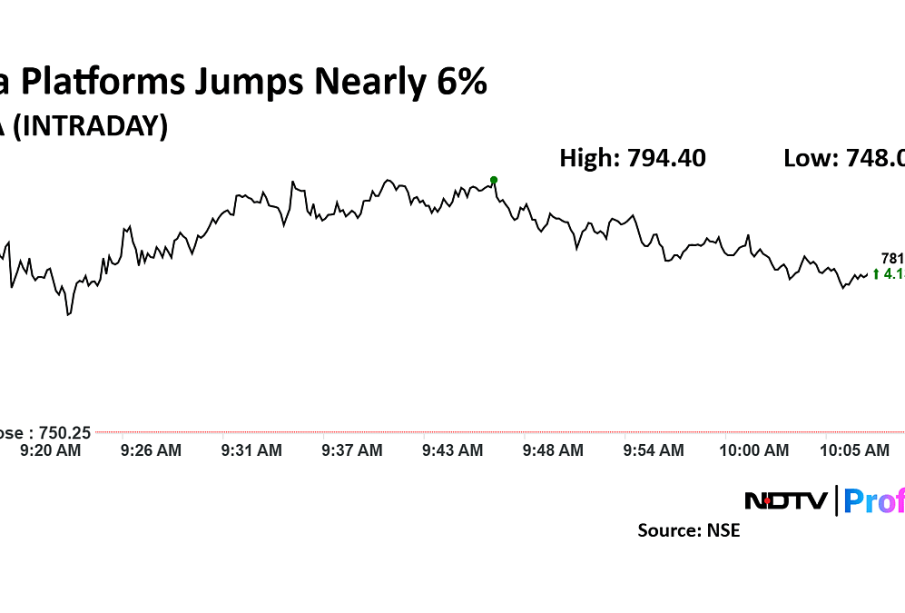

Current Status of Tanla Share Price

As of the most recent trading session, Tanla’s share price is experiencing notable changes. After reaching an all-time high in June 2023, where the shares were trading at around ₹1,200, the price has seen a gradual decline, largely attributed to broader market corrections and sector-specific challenges. Currently, the stock is trading around ₹900, reflecting a loss of approximately 25% from its peak.

Factors Influencing the Share Price

Several factors are influencing the current state of Tanla’s share price. First and foremost is the overall sentiment in the tech sectors, especially in the post-pandemic world where reliance on digital communication has increased. However, concerns surrounding regulation in the tech space and increased competition have led to volatility.

Furthermore, analysts have pointed out the impact of quarterly results on the stock’s performance. In its latest earnings report, Tanla reported a 15% increase in revenue but a slight dip in net profit margins due to rising operational costs. This mixed financial performance has contributed to investor uncertainty.

Expert Opinions and Future Projections

Market analysts remain divided regarding the future trajectory of Tanla’s share price. Some analysts are optimistic, citing the company’s continuous innovation in cloud communication and expansion into new markets, which could rapidly reverse the current price trend. Other experts warn of the continuing market conditions that may suppress stock growth.

The average price target among analysts stands at ₹1,050 for the next quarter, suggesting a potential recovery as businesses adapt and expand their communication needs. However, investors are advised to remain cautious and monitor global economic signals that impact tech shares.

Conclusion

In summary, as the stock market continues to fluctuate, staying informed about Tanla’s share price is crucial for investors. The company’s role in the evolving digital landscape, coupled with its fluctuating financial metrics, indicates a potentially profitable yet risky investment. As always, investors should conduct thorough research and consider expert insights before making financial decisions.